Top 4 Real Estate Investing Strategies To Uncover Leads in 2022

Contrary to a few circulating headlines, real estate industry experts predict home price appreciation will slow in 2022. Many expect the Fed to start raising interest rates sooner than initially anticipated to offset inflation concerns.

Don’t miss out on the chance to see firsthand how PropertyRadar can supercharge your real estate investment strategy. Start your free trial today!

Real estate investors waiting on the sidelines for a wave of distressed inventory will likely be sitting out another year as foreclosures will be an unlikely source of deals in 2022.

Investors relying on home price appreciation to offset poor buying decisions or rehab budget overruns should proceed with caution.

The market is less likely to save investors from terrible buying decisions in 2022.

To that end, real estate investors should expect four trends to drive four off-market real estate investing strategies in 2022.

The Market Trends That Are Influencing Real Estate Investing Strategies In 2022

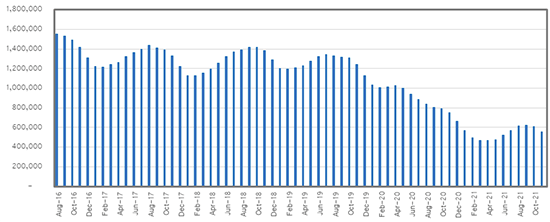

Low Inventory

Active listings nationwide were down over 25% in 2021. Record-low inventory and strong demand led to record-breaking equity gains, which are expected to continue in 2022, albeit at a slower pace. Even properties in disrepair will have multiple bids when listed through the MLS.

Off-market opportunities will be the #1 source of investor deal flow in 2022.

Housing Inventory: Active Listing Count in the United States

Source: Realtor.com

Distress + Equity Gains

While foreclosures will be an unlikely source of deals in 2022, distressed inventory via owners dealing with death, disease, divorce, drugs, and denial situations will be. National and state moratoriums and assistance programs are ending. Massive equity growth will give those facing challenging circumstances options.

A quick, all-cash sale will be an attractive alternative to dealing with expensive repairs, hard-to-find skilled labor, and extended timelines.

Aging Population

US life expectancy is 78 years, and the oldest Baby Boomers are now 75. Historically, as we age, we become net sellers of real estate. This group will be an essential source of off-market inventory in 2022.

Expect Boomers nearing end-of-life to downsize and liquidate homes and investments.

Lack of Housing

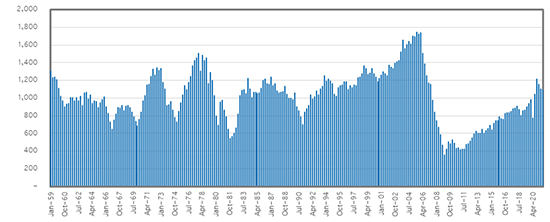

New Privately-Owned Housing Units Started: Single-Family Units (numbers in 1,000s)

Source: US Department of Housing and Urban Development

Builders have yet to return to the pre-Great Recession building levels. Build-to-suit has been their focus instead of developing large tracks that protect them from losses during market corrections.

However, the build-to-suit strategy has left builders wildly unprepared for the pandemic-led frenzy into real estate. Supply chain disruptions, massive material price increases, and wage increases complicate matters. Building profitably has become more of a challenge that will continue in 2022.

With such little inventory available, off-market real estate investing leads will be your guiding light this year.

🔥🔥🔥 Off-Market Will Be On Fire In 2022! 🔥🔥🔥

Off-market real estate deals will be where most investors find or create deals in 2022.

Learn more about finding off-market properties here.

Main Street investors should expect continued competition from Wall Street via buyers and Institutional players that have raised billions to diversify into the world of physical real estate. Local investors paying close attention to these players will learn what they buy in the local market.

The good news is that Main Street investors benefit from the millions Wall Street is spending publicizing the benefits of the fast, all-cash offer to the average homeowner. When a local investor understands what these Wall Street players don't want, it's easier to focus on inventory with less competition.

With these trends in mind, here are the real estate investing strategies that will drive off-market deals in 2022.

Don’t miss out on the chance to see firsthand how PropertyRadar can supercharge your real estate investment strategy. Start your free trial today!

The 4 Real Estate Investing Strategies To Get You More Leads In 2022

1. Absentee Owners

An absentee owner is an individual or corporation that legally owns a particular property without occupying it. For the sake of this strategy, we include second homes due to pandemic trends.

Second Homes. With employers allowing workers to work remotely, popular second-home markets have experienced an increase in full-time owner-occupants moving to these popular areas. While no public records criteria exist that signifies a property is a second home, investors typically know hot spots where these properties are prevalent.

The two data points to help discover these second-home leads include owner-occupancy status and living out of the area.

See this sample quick list for second home leads in Tahoe, CA, with over 3,000 leads.

Landlords. The absentee landlord list is one of the most popular. Landlords become motivated sellers for a variety of reasons. The owner may have inherited the property with no experience, an out-of-state investor may have hired a terrible property manager, or perhaps the landlord is simply tired of dealing with the three Ts (tenants, toilets, and trash).

The main criteria to discover absentee landlord leads is owner-occupancy status.

See this sample quick list for landlord leads in Phoenix, AZ, with over 105,000 leads.

Targeting landlords that live in a different county narrows the list to 35,000.

Aging landlords. One of the most powerful data sets to layer on top of the landlord list is the age of the landlord. An aging landlord may be tired of dealing with tenants, tired of repairs, or has taken all the depreciation tax benefits. A savvy buyer may also find landlords that own numerous properties and have the chance to negotiate an entire portfolio of properties and even pursue seller carryback financing.

This sample quick list adds owners aged 65 and over in Phoenix, AZ, and now shows 10,000+ leads.

2. Land Investing

When land is hot, it's hot. When land falls out of favor, it does little but hold the world together while incurring property taxes and lot clearing costs. Land investing is attractive to newbies because of its lower price point. But getting caught with land in the wrong cycle can be painful. Currently, lending has yet to return to the ultra-aggressive lending practices on raw land and infill lots seen during the last boom, which will likely cap price escalation.

Infill projects are attractive to real estate investors because expensive infrastructure like streets and utilities are already in place. Entitled infill lots are far more marketable than raw land that must go through the lengthy and sometimes costly entitlement process.

Infill lots can exist because they were never developed, a lot split occurred, or the previous project was demolished. Infill lots can also exist because of endangered species (animal or plant varieties) or environmental concerns (flood, fire, earthquake, and pollution), making development far more costly, if not impossible. Local knowledge and due diligence help protect against the later risk factors.

Marketing to landowners is different because owners are typically less emotionally attached to dirt. It's not unusual to find landowners with little knowledge of the local market and pricing. They may have never stepped foot on site.

Target land leads by searching for the type of construction project you want to build (residential, mobile home, multifamily, commercial, etc.). Further target the list by focusing on landowners who live out of the area, have owned for a long time, or have purchased in specific cycles.

Check out this residential land list in Cape Coral, FL where out-of-state owners purchased residential lots in the peak years of 2005-2008.

Land prices fell substantially post-Great Recessions, with lots selling at one time for $100,000 selling for under $10,000 just a few years later.

3. Value-Add Strategies

Politicians nationwide have been acutely aware of affordable housing issues well before the pandemic. States have been creative in making new value-add opportunities easier, faster, and less costly. Investors are well poised to take advantage of these new value-add projects.

Accessory dwelling units (ADUs). These secondary structures are not new and are often called casitas, in-law suites, or backyard homes. State legislators in California forced 60-day permit approval, lowered fees, and forced all municipalities in the state to allow, by right, investors, and homeowners to build ADUs as large as 1,200 square feet.

Numerous states are considering ADUs to deal with the housing shortage. Find suitable sites for ADUs by looking at lot square footage compared to the size of the property.

See this sample accessory dwelling unit list in Los Angeles, CA looking at lots at least 7,500 square feet in size and where the single-family property is no larger than 2,500 square feet. There are over 17,000 opportunities.

Lot Splits. An investor may offer market price on a single-family home located on a large lot, knowing the local city is amenable to lot splits. The investor can purchase, rehab, and resell the existing property while performing the lot split and later constructing a new property. The process can be easier if a local investor knows where the city is strategically trying to increase density. Investors will find clues in a city's general plan, planning commission notes, or interviewing city employees with development knowledge.

See this potential residential lot split list in Seattle, WA, on lots at least 12,500 square feet. There are over 6,500 opportunities.

Upzoning. If you thought neighbors would freak out about an accessory dwelling unit in the backyard, wait till they hear cities like Minneapolis are abolishing single-family zoning. They may end up with a triplex next door. Cities are exploring doing away with single-family zoning to deal with housing shortages. Policy-based upzoning projects are best executed by local real estate investors intimately aware of local zoning and development priorities. The state sets some policies, but cities can overlay more flexible rules. For example, SB10 in California passed in 2021, allowing some lots currently zoned single-family to potentially have up to 10 units and two ADUs on the same lot. The state-led bill asks cities to identify areas where these projects are most appropriate.

Another upzoning opportunity is where a lot has been upzoned but the current owner has yet to take advantage of the change.

See this upzoning list in Riverside, CA where the city has lots listed as R2 (duplex), R3 (triplex), and R4 (fourplex), but where the lot currently still has a single unit on site. There are currently over 2,200 opportunities, many of which are in opportunity zones!

4. Five "D" Life Events

Investors are constantly hunting for inside clues that lead to more off-market real estate deals. The following five life events are popular sources of motivated seller leads for real estate investors impacting both owner-occupants and landlords.

Investors come across these leads on the NOD or preforeclosure lists. They also run into these leads as they market to off-market opportunities.

Death. Some owners pass without an heir while others will their property to heirs with no experience managing property or that don't get along. Strong people skills and patience are big assets when dealing with these leads.

A local investor may watch obituaries to creatively connect with potential leads before they hit the realm of public records. Another way is to focus on the affidavit of death of joint tenant when the property transfers to the surviving owner.

See this sample death of joint tenant list in North Carolina within the past 365.

Disease. Poor health can have significant impacts on income, and the home is often the main asset families can tap in times of financial need. A way to potentially catch these leads is by watching preforeclosures. Long considered one of the best lists for finding motivated sellers, an owner is in "preforeclosure" when a lender files a notice of default. The owner is at risk of losing their home to foreclosure if they don't bring their loan current or sell. An investor can research estimated equity in the search to only target preforeclosures with equity.

See this sample preforeclosure list in Raleigh, NC.

Divorce. Working with two infighting individuals who recently ended their relationship might not get you jumping out of bed in the morning. But attorneys must be paid, and assets split. Investors may stumble upon divorce leads via the preforeclosure list, but these leads will often result from your marketing to properties with equity in your target areas and price point.

Drugs. Some leads may come from well-publicized arrests or property damage from drug manufacturing in local media. Unique to this particular life event is toxic remediation, depending on the drug involved. These leads may also appear on the preforeclosure list as owners dealing with drug use miss payments. These leads will also naturally surface as you market to equity sellers in your target markets.

Denial. Cycles dominated by equity seller leads see investors dealing with all kinds of life issues and circumstances. Denial is often a significant hurdle for owners in crisis, even faced with imminent foreclosure and eviction. Negotiating skills become secondary to relationship building and problem-solving to help owners see beyond their current situation and circumstance.

Connecting with Off-Market Leads

Pulling lists using a tool like PropertyRadar that includes enhanced public records data and criteria like demographic data, email addresses, and phone numbers open new ways for real estate investors to connect with prospects.

Marketing can and should be highly targeted and personalized for increased engagement. Check out PropertyRadar’s Good Neighbor Marketing Pledge on best practices for marketing and to make sure your team is following national and state regulations.

Direct mail. There's a reason why ibuyers love mail. It works! Hyper targeting lists and messaging go a long way to improve ROI and drive traffic to other assets like an investor's website. Investors will want to consider stacking other marketing avenues to create powerful, multi-touch, multi-channel marketing campaigns.

Cold Calling. Calling hyper-targeted leads is a powerful channel for investors in 2022. As with any marketing, you never want it to be scammy, spammy, or insensitive.

SMS & VMD. Cold text message and voice mail drop marketing have become wildly popular due to extremely high open rates and low cost. Text messaging has a 98% read rate.

Email Marketing. Recent data shows cold email opens range from 14-23% with 24% opening in the first hour. It's a great channel for easy follow-up and great as a secondary marketing channel when combined with other strategies like direct mail. See PropertyRadar’s Good Neighbor Marketing Pledge for ideas on how to avoid spam folders.

Digital Ads. PropertyRadar makes Facebook and Google custom audiences easy. Hyper-target your list with digital paid ads to reach your exact match instead of hoping the right audience is seeing your message.

Door knocking. Driving for dollars will always be an excellent strategy for creating lists that no one else can replicate. Properties in disrepair can be added to lists for later research and segmenting for further targeting via mailers. Door knocking becomes far easier when you have more information on the property, equity position, details on ownership, and a little about the owners.

Use These Real Estate Investing Strategies To Crush It In 2022!

Real estate investors will find that equity gains over the past few years will significantly increase their list sizes if more diligence isn't used to hyper-target prospects. Find a niche and the corresponding public records criteria that make your marketing easier, better targeted, and more personalized for better ROI in 2022 and beyond.