Foreclosure Cancellations Continue to Climb

Short sales and loan modifications are not the only explanation

Discovery Bay, CA, May 11, 2010 - PropertyRadar (www.propertyradar.com), the only website that tracks every California foreclosure and provides daily auction updates, issued its monthly California Foreclosure Report for April 2010. Foreclosure filings were down in April for the first time since the beginning of the year. Despite the decline in filings, the inventory of properties in preforeclosure or scheduled for sale only dipped slightly as the drop in filings were offset by an increase in the time to foreclose. Cancellations continue to climb, up more than 32 percent from the beginning of the year. The number of properties sold to 3rd parties also continues to climb, helped again this month by slightly better discounts." The steady rise in cancellations leads us to believe that loan modifications and short sales are gaining traction" says Sean O'Toole, Founder and CEO of ForeclosureRadar.com. "I'd caution, however, that cancellations also occur due to filing errors and extended postponements, which require the Notice of Trustee Sale to be re-filed. In fact, 14.6 percent of new Notice of Trustee filings in April were on previously cancelled foreclosures."

|

|

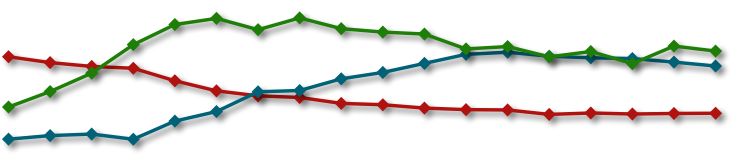

Foreclosure Filings

Notice of Default

Prior MonthPrior Year-16.01%-41.20%

Notice of Trustee Sale

Prior MonthPrior Year-10.25%-3.10%

Notice of Default filings is the first step in the foreclosure process. Notice of Trustee Sale filings set the date and time of auction and serve as the homeowner's final notice before the sale.

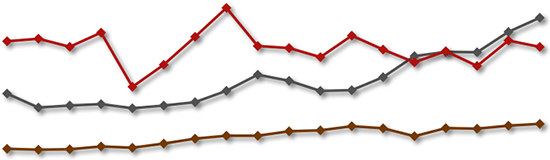

Foreclosure Outcomes

Back to Bank (REO)

Prior MonthPrior Year-5.52%19.53%

Cancellations

Prior MonthPrior Year11.39%174.37%

Sold to 3rd Party

Prior MonthPrior Year6.05%158.62%

After the filing of a Notice of Trustee Sale, there are only three possible outcomes. First, the sale can be cancelled for reasons that include a successful loan modification or short sale, a filing error, or a legal requirement to re-file the notice after extended postponements. Alternatively, if the property is taken to sale, the Bank will place the opening bid. If a 3rd party, typically an investor, bids more than the bank's opening bid, the property will be Sold to 3rd Party; if not, it will go back to Bank and become part of that bank's REO inventory.

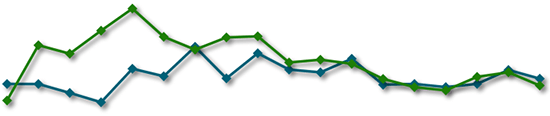

Foreclosure Inventories

Preforeclosure

Prior MonthPrior Year-3.17%-17.69%

Scheduled for Sale

Prior MonthPrior Year-2.77%49.72%

Bank Owned (REO)

Prior MonthPrior Year0.26%-19.95%

Preforeclosure inventory is an estimate of the number of properties that have had a Notice of Default filed against the property but have not yet been Scheduled for Sale. The Scheduled for Sale inventory indicates those properties that have had a Notice of Trustee Sale filed, but have not yet been sold or had the sale cancelled. The Bank Owned (REO) inventory indicates the number of properties that have been sold Back to the Bank at the trustee sale, and which the bank has not yet resold to another party.

8-Nov8-Dec9-Jan9-Feb9-Mar9-Apr9-May9-Jun9-Jul9-Aug9-Sep9-Oct9-Nov9-Dec10-Jan10-Feb10-Mar10-Apr96534112078130550159215179412185603174243186060175283171841169860154905157288146941152322140126157768152770642376784169374641778239092002111824113141124874131300140382149456151573147570145977145260141669137741147090141176137331135488122901112792107762106139100206988299547993926935958911990551895299006590295

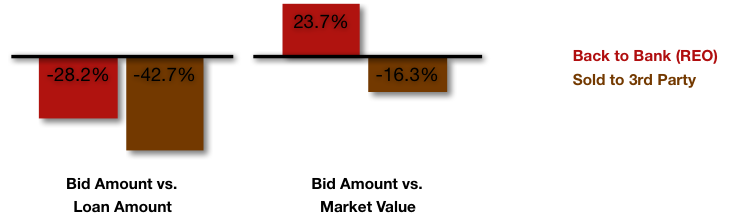

Foreclosure Discounting

Foreclosure discounting compares the winning Bid Amount of properties sold at a trustee sale to both the outstanding Loan Amount, and the current Market Value. Banks place an opening bid for each property, and if a 3rd Party does not make a higher bid the property will be sold Back to Bank (REO) for the opening bid amount. While 3rd Party bids are higher than the opening bid, properties Sold to 3rd Parties typically have lower opening bids to start with and therefore deeper discounts to both Loan Amount and Market Value.

Foreclosure Timeframes

<tr >Prior MonthPrior Year

Time to Foreclosure

6.22%40.07%

Time to Resell - Bank

Prior MonthPrior Year6.47%5.56%

Time to Resell - 3rd

Prior MonthPrior Year5.88%-17.35%Time to Foreclose is the total time from the filing of the Notice of Default to the sale of the property at the trustee sale and reflects those properties sold in the month indicated. Time to Resell reflects how long it takes banks and 3rd parties to resell the properties they take back or purchase at trustee sale.

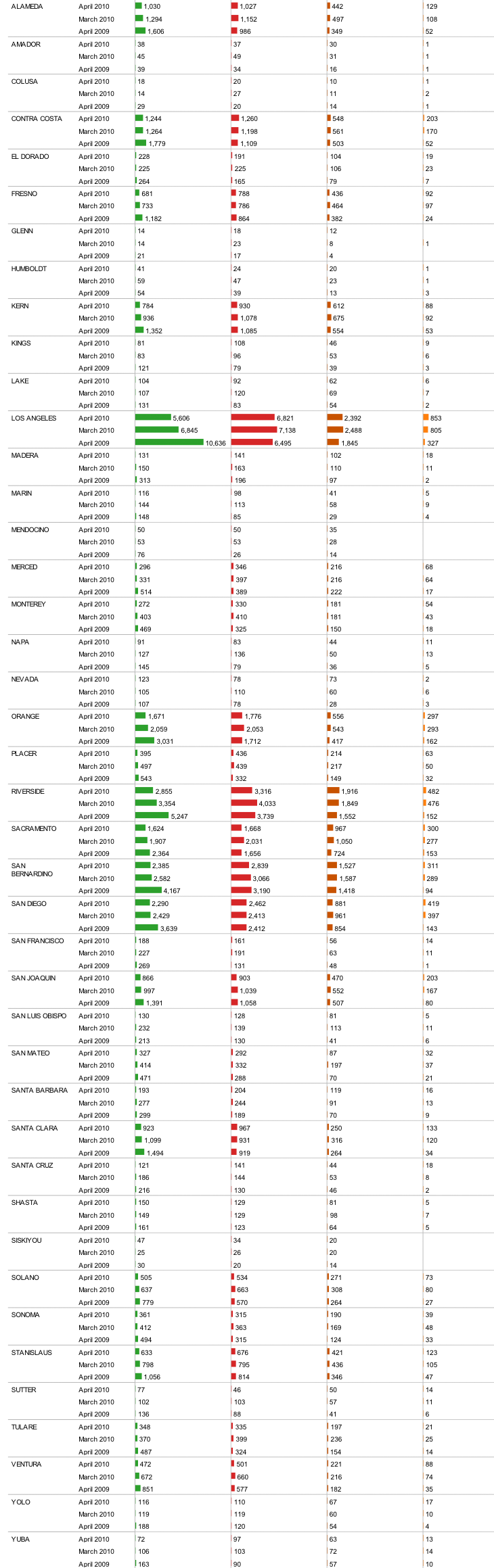

Foreclosure Activity By County

Notice of DefaultNotice of Trustee SaleBack to Bank (REO)Sold to 3rd Pary