How To Find Off Market Properties and Turn Them Into Off Market Deals

Roughly 5% of properties nationwide sell every year. Within 20 years, most properties in a market change hands. Expert real estate investors and agents don’t wait for a potential prospect to reach out or for a returning customer to call. They keep their pipeline full by actively focusing on hyperlocal and hyper-targeted marketing to off-market opportunities.

|

Try PropertyRadar FREE for 3 days |

Every on-market deal today started as an off-market opportunity. If you’re motivated to find off-market real estate deals and are curious about how the pros turn them into deals, keep reading. This article is a guide on how to find off-market properties using data-driven intelligence, actionable insights, and time-tested strategies.

We’ll cover:

- What are off-market opportunities

- Why do owners work with off-market experts?

- Why Realtors and investors target off-market opportunities

- Strategies to find off-market opportunities

- List stacking off-market opportunities like a pro

- Understanding and refining lists with advanced insights

- Marketing and connecting with off-marketing leads

- Becoming an off-market expert using automations and integrations

What are off-market properties?

The term “off-market property” can refer to any property not currently listed for sale on the MLS or other For Sale by Owner (FSBO) sites like Zillow, Trulia, Facebook, or Craigslist.

When first contacted, sellers of off-market properties are not usually interested in selling their property. While farming to all households is standard practice for Realtors, strategically marketing to properties where life events or distress may soon lead to a sale is different. When such moments arise, a real estate professional wants to be top-of-mind and first in the door. If roughly 5% of properties change hands every year, what percentage will be yours?

Why are properties sold "off-market"?

Investors target off-market opportunities to enjoy less competition, avoid commissions, and obtain a discounted price. Sellers extend a discount and leave equity on the table because of the benefits unique to an investor offer, including all-cash, fast closing, and an as-is condition sale with no contingencies. Whether you’re looking for off-market residential, commercial, land, industrial, mixed-use, or other types of property, you’ll find it in PropertyRadar. Why limit yourself to what is listed on the MLS when you have unlimited opportunities in off-market real estate?

8 reasons owners sell off-market properties to investors

It’s essential to separate investors and agents when looking at off-market opportunities because the benefits in the eyes of the owner are very different. There are a variety of reasons a seller would prefer an investor offer, including:

Speed. A fast sale is a standout benefit that an investor offers. Gone is the need to deal with financing and stacked sale contingencies. An owner knows that an investor is buying the property as-is, all cash, and can close in as little as a week if needed.

Cash. An investor's offer is rarely contingent on financing. While an investor may choose hard money or private money, speed often occurs because financing is not part of the equation. No financing means no appraisal is necessary, and the property can close quickly. The seller can use the cash for their next transaction or solve a current life situation.

Condition. Selling a property that needs heavy repairs isn’t easy. A property can be in such disrepair that a new buyer may have issues obtaining financing. Whether a property needs massive updating, or structural repairs, is a hoarder home, or has experienced a fire, sellers turn to an investor offer because they lack the experience, time, money, or will to handle the repairs on their own.

Privacy. Off-market sales allow owners to maintain privacy. Far from being a pandemic-driven concern, some sellers dislike strangers walking through their homes. Off-market properties offer a more private and discreet transactional process. There won’t be a sign advertising the property is for sale, no nosey neighbors will come poking around, and there’s no judgment on the property condition. The investor will buy the property in as-is condition with no contingencies.

Distress. Investors often discuss the five Ds of distressed real estate: death, disease, drugs, divorce, and denial. Numerous life events cause distress where the owner may ultimately decide an as-is cash offer is the best and fastest solution. In many cases, finances will have changed where a sale is required, but the owner doesn’t want to list the property on the MLS for various reasons, and an investor option is the best option.

Title and legal problems. Sophisticated investors may help owners who cannot sell their home due to clouded title or pending legal actions. This can be a win-win, allowing the owner to cash out and move on while the investor can make significant returns by using their resources, knowledge, and patience to resolve the problem.

Flexibility. Timing and creativity are two essential benefits of an investor offer. A seller may be trying to time another real estate transaction or business opportunity, and an investor offer may be able to create out-of-the-box proposals that meet their needs. This can include seller leaseback, seller financing, or an extended closing period.

Tenants. Selling a property with a tenant in place is difficult as it limits potential buyers. An aging landlord may have difficulty timing an exit if the tenant recently renewed their lease or perhaps is trying to time the tax ramifications of a sale. Maybe the seller wants to see a long-term tenant remain and would prefer to sell to a fellow landlord. There’s also a chance the current tenant isn’t paying, and the landlord is willing to leave equity on the table to not deal with the issue, especially if the tenant is a family member.

Investors are facing increased competition from iBuyers and institutional Wall Street players. These Wall Street players have attempted to scale the investor offer in major metropolitan areas, but these players aren’t always willing to offer the same eight benefits local investors can. Local investors are far more inclined to take on properties needing heavy repairs with unique people issues. Most Wall Street offers only address speed, cash, and privacy out of the eight points listed. A local investor that understands this can use data – which we will cover later – to better connect with those opportunities that Wall Street doesn’t want.

Why do agents target off-market homes? And why owners love them!

100% of listings on the MLS today started off-market. Commercial and residential listing agents that dominate a market know how important farming is for long-term brand building. Marketing to specific off-market opportunities is a little different as the focus is keeping the sales pipeline full by focusing on properties most likely to sell in the near future. Real estate teams and agents with niches can easily control a category by continually showing off recent activity and sold transactions to similar properties and owners in the market.

Listing agents aren’t the only ones that can be off-market experts. Buyers’ agents immediately set themselves apart from other agents by going the off-market mile. Lazy buyer’s agents wait for the new listing to show their buyers, which instantly get bombarded with offers. A savvy buyer’s agent can market directly to owners of properties that exactly fit a buyer’s wants and needs, asking if they or a neighbor are looking to sell soon. There’s power in having prequalified buyers looking for exactly what they own. This data-driven approach shows you go the extra mile for your clients and could easily lead to listing opportunities in the future.

Challenges of off-market real estate

Off-market real estate for commercial and residential real estate agents face few challenges outside of spending the money and time to market their specific niche and avatars (ideal customer). We’ll show you how to do so while saving money shortly.

However, when an opportunity is better suited for an investor offer, savvy agents quickly turn to their reliable local investors to get a deal done in hopes of landing the listing once the referred deal is renovated. The investor offer entails more risks, and an investor-friendly agent that understands those risks is a powerful partner.

Here are five risks investors face and ways to mitigate them.

Money. Cash drives the speed of an investor’s offer. An investor needs cash or access to capital to get the deal done. If an investor doesn’t have cash, they can pursue wholesaling or approach certain owners about creative structures. But, at the end of the day, an investor needs to have the financial bandwidth to buy and renovate one or multiple properties at a time. Or, they must have strong referral options lined up to ensure no good deal goes unclosed. Investors don’t walk with a commission for solving the problem. They close the deal, own the problem, but only get paid if the deal makes money.

Valuations. Under-improved or over-improved properties can be expensive mistakes depending on the market cycle. A local real estate investor typically has a well-defined buy box or property specifications they are looking to buy. Staying within tight parameters allows them to become experts at rehab costs and comparable sales. Mitigate amateur mistakes by performing competitive research, watching local flippers and their rehabs, and seeing what features maximize values. Every market is different. Take your local volume agent to lunch to discuss trends and valuations in your particular price point when in doubt.

Repairs. Investor deals rarely come with pictures, extensive disclosures, or a list of known property issues. As-is sellers typically demand fast transactions, which means short due diligence times. An investor must mitigate risk by understanding the likely rehab level needed to bring the property to market value, even if they can’t see everything. The ability to spot potentially dangerous and expensive repairs like structural issues, mold and aging big-ticket items like plumbing, electrical, and roofing is critical. If repairs scare you, hire a contractor for a day to walk you through specific project costs, volunteer at your local Habitat for Humanity repairing houses, or take classes at your local hardware store. You can also avoid marketing to off-market deals with a higher likelihood of having these issues.

Negotiating. Investors negotiate deals directly with owners and must have a solid understanding of evaluating deals, estimating appropriate repairs, creative structures, and making sure they create deals that make money. Not having representation means you have to be the expert deal maker. You also have to be certain you’re negotiating with all interested parties needed to sell the property.

Paperwork. Most investors structuring off-market deals are unlikely to use copywritten, state-specific agent forms. Using an experienced local closing or escrow agent ensures you’ll have all the needed information to close a transaction with the appropriate paperwork to ensure you don’t cause unnecessary title issues. Frequently, these professionals have more consumer-friendly forms.

Understanding who targets off-market properties and why sellers would consider selling to off-market experts is one thing. Becoming an expert at driving leads and creating deal flow is another.

|

Try PropertyRadar FREE for 3 days |

Creating off-market real estate leads

When local professionals trust you as a fellow local pro, it’s possible to become a deal magnet for off-market properties from a variety of sources.

- Realtors: Local professional agents understand not all listings are destined for the MLS. When a property has needed repairs, people issues, or problems to be solved, they’ll contact their preferred local investors for an offer.

- Attorneys: Lawyers with specialties that involve real estate like divorce, probate, personal injury, and estate planning can be a great source of referrals.

- Service companies: Home inspectors, handypersons, lawn care, termite and pest control, and pool maintenance professionals can watch for distress or potential moves on their local routes.

- Wholesalers: A serious local wholesaler is worth its weight in gold. Connect with these marketing juggernauts and get leads in your inbox without the heavy marketing lift. For agents, you could get a leg up on the competition knowing months before a property is repaired and listed.

- Investors: If an agent isn’t an investor, they should always have a local real estate investor on the team. For investors, you may see other flippers as competitors, but they can also direct inventory your way when they can’t take on one more project or a project is not within their specialty. Network and be their go-to backup.

- Property managers: Network with professional management companies that might send you properties that have aged and need substantial upgrades to maximize rents or to resell. You may get a chance to bid on a portfolio from an aging landlord.

- Nonprofit boards: Most nonprofit boards have a mix of financial, legal, and community professionals. Join for the mission, benefit naturally from the networking. Joining housing-related boards will be more meaningful but be aware of conflicts of interest.

- Commissions: Volunteering within your local city or county on the planning commission or similar committees allows you to follow significant projects, upcoming city improvements, and code changes before they happen.

Referrals are a great source of off-market deals when others in your network know who you are, trust you, and understand what you are looking for in the market.

Connect with Local Wholesalers

We dedicated an entire post to wholesalers because local professional wholesalers are incredibly valuable to investors and agents alike. When discussing wholesalers, we aren’t referring to newbies at your local investor club who toss around this title because they are just getting started. Professional wholesalers spend thousands every month marketing to off-market sellers. This includes door knocking, direct mail, email, calling, and texting campaigns. They create follow-up systems to attract and manage lead generation activity to connect and pass those deals to other professionals that will either list, fix and flip, or repair and hold the property.

Most wholesale deals are destined to a flipper that will repair and resell the property or a landlord that will renovate and lease the property. Most wholesalers have a mix of flip and hold investors on their buyer’s list.

Referrals and wholesalers are excellent sources of leads, but there is always a middle person between you and the prospect. What if your contact retires, moves, changes careers, or finds a preferred recipient for those leads? Professionals know it’s dangerous to have middle persons standing between prospects.

How To Discover Off-Market Leads

Learning to discover, understand, and connect with off-market opportunities directly is imperative for professionals looking to control their deal flow and growth. Luckily, you don’t need to be a data scientist or even a marketing genius to find and connect with off-market opportunities.

While your competition is buying oversized and outdated lists, you can create hyperlocal and hyper-targeted lists using over 250 criteria to target specific niches and opportunities with PropertyRadar. These lists can even update themselves. The more defined and tailored your lists, the better you’re able to refine your messaging to best connect with potential sellers, drastically increasing your ROI. Most real estate professionals target a 1-2% return on their marketing. Let’s explore how to hit those expert results.

Driving for Dollars

Driving for dollars is one option for targeting off-market real estate that doesn’t technically need a list. This method, as it sounds, entails driving around looking for properties that have signs of distress, including boarded windows, overflowing mailboxes, roof damage, overgrown yards, code enforcement tags, and other property deterioration. Once you spot something of interest, you’ll need to find the owner of that property.

Discover Off-Market Leads with Custom Lists

Amateurs buy lists, professionals build lists, and experts automate lists. We’ll have you curating highly targeted lists supporting your specific niche in no time. We promised that you didn’t need to be a data scientist to get started, which is the job of quick lists.

Popular Off-Market Lists and Quick Lists

Quick lists are the most popular lists tailored to specific professionals like Realtors, commercial brokers, and investors. You’ll select a location and then select a Quick List to get started. Samples of quick lists:

| Real Estate Agents | Real Estate Investors | Commercial Agents |

|

|

|

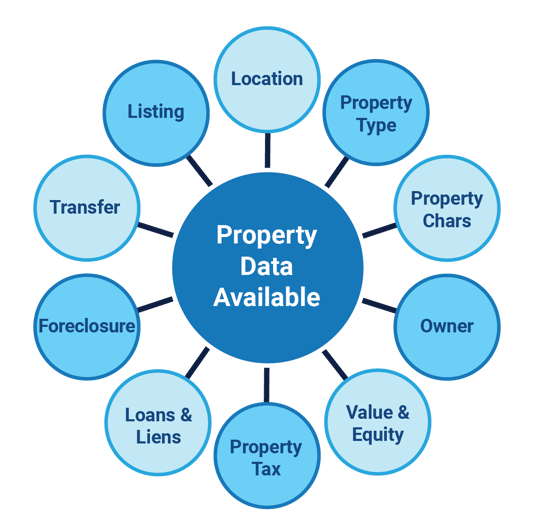

Of course, quick lists are helpful but with 250 criteria, you can list stack in unique and creative ways. Let’s explore the 10 major categories of data and how they can help you find off-market opportunities.

Search off-market properties by location

Targeting by location is easy enough. Most do so based on state, county, and city. But those lists can get unnecessarily large and unfocused. You can narrow your target location based on many things like zip code, address number, assessor parcel map, subdivision, Census tract, Congressional district, FIPS code, or even a custom map you create.

Whether you’re an agent farming in a specific neighborhood or an investor targeting properties on a particular side of the street with a view, there are numerous ways to explore a location.

If you are signed up for PropertyRadar’s free trial or are a current subscriber, the hyperlinks on example lists will open in the app so you can explore how they are constructed. Simply update the location, and you’re off to the races creating a look-a-like list in your backyard.

Lists by location examples:

- Farm list of owner-occupant properties in Galveston, TX

- List of odd-numbered addresses on St. Johns River that captures only waterfront properties

- Mobile homes within a 15-mile radius of Fort Benning in Columbus, GA

- Apartment buildings in Arlington, VA (close to Amazon’s new headquarters)

Off-Market Properties by Property Type

After location, searching by property type is next on the list. You likely have an interest in a particular type of property. Maybe you’re the Condo Queen specializing in listing local condos. Or perhaps you’re an investor looking to target multifamily 2–4-unit properties. Other property types include commercial real estate, hotels, land, and industrial properties. It’s easy to add those criteria to refine your search.

With PropertyRadar, you also have ways to narrow your search from “Basic Type” to “Advanced Type” in your property search. For example, the basic category of Single Family includes advanced options of townhomes, mobile homes, cabins, manufactured homes, and single-family residences.

Lists by location examples:

- List of Multifamily 5+ in Chicago, IL

- List of Apartments in Detroit, MI

- List of Industrial lots in Atlanta, GA

- List of Hotels and Motels in Seattle, WA

Off-Market Properties by Property Characteristics

With the type of property selected, you can now add the “Characteristics” you want your property to have. These include the number of beds and baths, square footage, lot size, year built, pool, fireplace, and more.

Characteristics are powerful for Realtors looking to create exact-match lists for clients seeking specific features and amenities. Investors can easily target their unique buy box that narrows properties by square footage and the number of bedrooms and bathrooms. And commercial investors will love the ability to target residential opportunities that can easily become multifamily or commercial opportunities using zoning.

Lists by property characteristics examples:

- List of two-bedroom and two-bathroom single-family properties in Portland, ME

- List of 2-4-unit properties on large lots in Indianapolis, IN

- List of condos in Pittsburgh, PA built after 2005

- List of single-family homes on 7,500 square feet or more of land without a pool in Palm Springs, CA

- List of properties zoned for a triplex but only has a single-family residence in Riverside, CA

- List of properties with no air conditioning system in San Diego, CA

- List of potential accessory dwelling unit (ADU) opportunities in Los Angeles, CA on single-story properties 2,500 square feet or less where the lot size is over 7,500 square feet

Off-Market Properties based on Ownership Type

Using ownership details and demographic information is one of the most powerful ways to refine lists that is unique to PropertyRadar. Ownership and demographic information allow you to tailor your message to better connect with the recipient. Would you market to an out-of-state landlord that owns 50 properties the same way you’d market to an owner-occupant over the age of 65? No!

PropertyRadar is one of the only tools that give you the power of demographic details and over one billion pre-appended emails and phone numbers so you can launch multichannel marketing campaigns. We also provide the ability for you to find and build lists of vacant properties and vacant mailing addresses. A vacant property is one where the US Post Office has labeled a property as unable to receive mail. PropertyRadar takes it one step further by letting you know if the owner’s mailing address is also listed as undeliverable by the US Post Office.

Lists by ownership type examples:

- List of aging landlords over 65 in Raleigh, NC

- List of vacant mailing addresses in Austin, TX

- List of out-of-state absentee owners in Las Vegas, NV

Off-Market Lists Based on Value and Equity

The value and equity of a property is another excellent way real estate professionals target their local marketing. Perhaps you’re a Realtor looking for move-up buyers and want to find potential sellers with 50% equity in their home. Or maybe you’re an investor that only wants to market to owners with at least 30% equity. Equity is a formidable way to save money only talking to people that have options due to their equity position.

Value of the property behaves similarly, and PropertyRadar gives you the versatility of selecting from property values based on the average valuation model (AVM), value by the square foot, assessed value, and HUD fair market value. An agent might use this to target off-market properties for first-time homebuyers under a specific dollar amount that mimics local FHA loan limits. An investor may use this to stay within their preferred buying range or buy box. As you’ll see in the examples below, it’s not unusual to have professionals use both value and equity in their criteria stacking.

Lists by ownership type examples:

- List of condos valued under $500,000 in Boston, MA

- List of 100% free and clear absentee multifamily properties in Dallas, TX

- List of single-family homes under $400,000 with at least 30% equity in Baltimore, MD

Off-Market Lists Based on Taxes

There are many ways to use tax data to find off-market deals. Create based on the assessed value of the property, or improvements separately, year assessed, estimated rate, tax delinquency, amount delinquent, how long delinquent, and whether the owner is claiming homeowner exemption.

An agent might target senior owners on low property tax basis. An investor may use delinquent taxes to identify potential distress. Both agents and investors can use homeowner tax exemption data to target second home markets more effectively.

Lists by taxes examples:

- List of single-family homes and condos with property taxes under $1,000 in Los Angeles, CA

- List of multifamily properties with taxes delinquent for at least two years in Kansas City, MO

Off-Market Lists Based on Mortgage and Liens

Mortgage data isn’t just for mortgage professionals. An agent might search for properties with VA loans to assist fellow veterans with a move-up opportunity. An investor may target equity owners with adjustable-rate mortgages due to reset. Agents and investors can use delinquent HOA and mechanics liens as an alternative to the popular preforeclosure list to spot signs of distress. After all, it’s not unusual for owners to keep their mortgage current but not pay the HOA or liens in tough times, falsely assuming they won’t eventually foreclose.

Loan and lien information can signal early signs of distress that others may not be watching. Lists by mortgage loans and liens examples:

- List of owners in VA loans with at least 50% equity in Tampa, FL

- List of owners with ARM loan set to reset this year in Albany, NY

- List of delinquent HOA liens on single-family homes in Salt Lake City, UT

Distressed and Foreclosure Lists

Many companies tout machine learning and artificial intelligence abilities in identifying homes most likely to sell. You don’t need to be a rocket scientist to understand that people in foreclosure are clear signs of distress that need resolution. The preforeclosure list is one of the most popular and also one of the most overused lists. How do you stand out?

PropertyRadar is the only tool that goes well beyond the preforeclosure list and gives professionals the ability to target owners based on the foreclosure stage. PropertyRadar is the only tool that also gives you the information to target based on foreclosure resolution, including whether a property foreclosure was canceled, sold, released, or whether the file is outdated. You can also create lists around the foreclosing loan position, amounts, and even the lender name.

Lists by distress and foreclosure examples:

- List of second and third position loans in foreclosure in Las Vegas, NV

- List of outdated preforeclosure properties in Albuquerque, NM

- List of preforeclosures not listed in Omaha, NE

Off-Market Lists Based on Transfer and Sales

PropertyRadar offers some of the most powerful data on the market when it comes to transfer and sales data. This data helps professionals better target owners based on when they purchased, what kind of transfer occurred, and what type of sale occurred previously, including drill-down capabilities looking to market transfers, short sales, REOs, and flips. Professionals can combine the transfer data with owner and equity information to target long-time owners over a certain age more likely to sell later in life.

Another off-market secret is looking at non-market transfers like the death of joint tenant, related party transfer, or if a trustee’s deed ended up reverting to the bank or selling to a third party. Professionals can stack this data with property type, value, equity, and ownership details to back into unique niches and opportunities that few know how to target.

Lists by transfer details and sales examples:

- List of iBuyers in California so far this year

- List of free and clear rentals owned for over 25 years in Little Rock, AK

- List of death of joint tenant in last 365 days in Nashville, TN

- List of property flips over the last year in Fort Collins, CO

Off-Market Lists Based on Listing Details

Listing details are the final category we will review as we show off the power and opportunities in stacking data to create hyper-targeted marketing lists. PropertyRadar goes beyond whether a property is currently listed, allowing professionals to know if the property is an REO, short sale, or standard sale. Pros can also search by days on market, price drops, the status of the listing, and more. One of the most potent uses of listing data is not who to target but who not to target. Professionals can avoid properties on the MLS, knowing they are explicitly targeting off-market opportunities.

Lists by transfer details and sales examples:

- List of owner-occupied single-family homes and condos with owners over the age of 55 that purchased before 2013, with 30% equity, not in foreclosure and not listed on the MLS in Milwaukee, WI

- List of multifamily properties withdrawn from listing last year in Billings, MT

Cleaning Up Your List of Off-Market Opportunities

With over 250 criteria to stack to your liking, it’s easy to see why PropertyRadar is the most powerful tool for hyperlocal real estate professionals interested in targeting off-market opportunities. One last list-stacking secret is ensuring you refine your list to exclude people who are unlikely to be interested in what you have to offer. Your exclusion list might include:

- Properties in foreclosure – unless you are targeting preforeclosures

- Properties currently listed for sale – you’re competing with anyone with access to the MLS

- Properties purchased within the last few years – if someone just purchased recently, are they likely to sell?

- Properties with a vacant mailing address – we recommend you target these separately as they may require additional skip tracing due diligence to track them down

Are you looking for inspiration for the top strategies to target? Check out our latest article on top off-market strategies for 2022.

Insights into Your Off-Market List

Congratulations on learning to create your perfect list! You’re on your way to being a list-building master, but there’s another step that can save you time and money that will set you apart from the competition. The next step to market domination is getting to know your list better than anyone else, searching for nuances and ways to hone your opportunities further. PropertyRadar gives you this ability with heatmaps, Dynamics Lists, and Insights.

Visualize Opportunities with Heatmaps

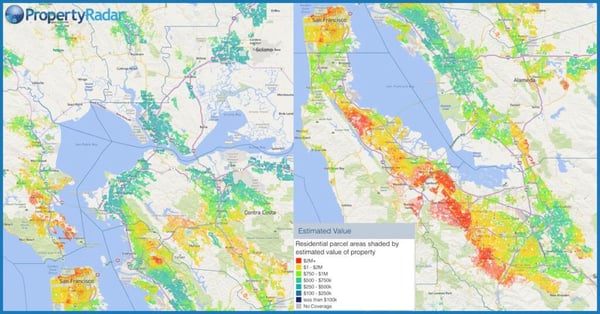

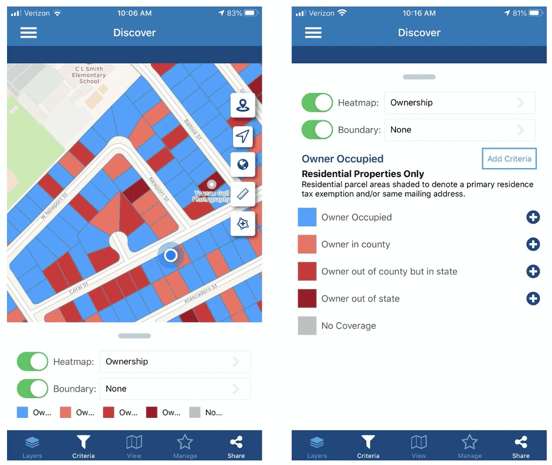

PropertyRadar’s patented heatmaps feature lets you “see” your neighborhood and identify potential clients at a granular level like never before. Imagine creating your list and then seeing those opportunities on a map. You can then enable heatmap layers to visualize additional data you may have never explored before because it’s impossible with a spreadsheet. Layers of heatmaps include:

Property heatmaps: Includes property types, square footage, and year built. Easily see your list and overlay information on property types to discover potential upzoning and expansion opportunities. Understand the areas where flippers are the busiest. Take intel learned from heatmaps to draw your perfect boundaries to focus on custom areas.

Value heatmaps: Includes estimated value, estimated equity, assessed value, debt, estimated value per square foot, and estimated tax rate. Easily spot high dollar areas, areas dominated by free and clear properties, identify locations where adding square footage would make the most profit, and quickly see places and price points dominated by absentee owners.

Transactions heatmaps: Includes turnover, sales, for sale, and foreclosures. Realtors and investors love to spot trends in turnover, sales, and distressed sales to spot areas to focus on or avoid for future projects or marketing.

Owner heatmaps. Includes ownership (owner-occupied, nonowner occupied), vacancy, ownership type, owner age, owner gender, children present, owner education, owner income, and business owners. Identify areas dominated by absentee overs versus owner-occupants, spot locations where young families are dominant and enjoy insights to better target affluent clientele on information beyond home price.

The heatmap feature is so powerful that people say they get addicted to using it because of the depth and breadth of insight that no spreadsheet can even come close to providing. Check out our video on heatmaps to see it in action.

Using Dynamic Lists

Have you ever wished leads could automatically be added to a list when they met your perfect criteria or taken off when a property sold? Welcome to PropertyRadar’s Dynamic Lists, which comes included in PropertyRadar. You can monitor and gain insights into lists as large as 10,000.

Unlike typical lists you buy from traditional list builders or list brokers, Dynamic Lists automatically update themselves when a new lead or opportunity matches your criteria. Say, for instance, you created a Dynamic List of aging landlords over 65. Setting up a Dynamic List means that any time a local landlord turns 65, they will automatically be added to your list. Should an aging landlord sell a property, that lead is automatically removed from the list. You’ll never have to buy and manage a stale list again.

Understand Your Market with Insights

PropertyRadar exclusive Insights functionality pulls the data about the people and properties on your list and visually presents it in charts and graphs. You’ll better understand what your leads have in common so you can create better messaging. You also see where they are different to better segment your lists. You’ll find non-obvious insights into the properties and people on your list your competitors miss.

Property Insights. Insights into properties include property type details, ownership type, sales volume, transaction volume, estimated equity, estimated value, year built, turnover, sales price, square footage, value per square foot, assessed to the estimated value, estimated tax rate, listed for sale percentage, and vacancy rate. You’ll understand the supply and demand dynamics in your market for both on- and off-market properties.

As a Realtor, this comes in handy when creating exact match lists. You see insights behind who owns the property, how long properties are typically held, and sales volume in the market. Knowing these trends sets you up as a true market expert and allows you to refine lists to better target potential sellers. Who needs artificial intelligence or machine learning to laser focus messaging and marketing?

Investors can use property insights to explore local flippers’ buy box, including ibuyers like Redfin, Opendoor, and Offerpad. Creating a list of local flippers over the last six months allows you to see the size, age, and price point of properties most targeted. You can choose to compete directly on similar inventory, sell them what they want (wholesaling), or find new niches in the market that are less crowded.

Owner Insights. Insights into people include how owners hold title, gender, age, education, marital status, income, net worth, children at home, ethnicity, charitable giving, interests, business ownership, and occupations.

Realtors rarely can see the demographic data behind lists. What if you could see a large portion of owners were single females, or the average age of the neighborhood was over 55, or that a large percentage of owners give to local causes? How might this intelligence change how your market, the visuals used in advertising, or charitable causes you support in your community? This information is invaluable for agents developing niches within specific property types or owner categories.

For investors, demographic insights allow you to refine lists and your marketing message based on ownership type, age, and even interests. Imagine sending postcards that feature an adorable kitten to households with animals listed as an interest. The lead may not be interested in selling today, but there’s a higher probability your mailer might end up on the fridge or in a drawer to be used to contact you when the seller is ready.

Heatmaps, Dynamic Lists, and Insights are advanced tools that help real estate professionals communicate with smaller lists of owners most likely to transact. Imagine the money you’ll save targeting smaller lists of hyper-targeted leads. And imagine how much more effective your advertising and marketing will be when you tailor messages and visuals to best connect with your target audience. Data isn’t just for Wall Street anymore.

Connecting with Your Off-Market List

You have now created and refined your perfect list thanks to PropertyRadar’s Insights functions. Now it’s time to connect with people on your list. PropertyRadar doesn’t stop at giving the mailing address of owners. With over one billion pre-appended emails and phone numbers, you can mix and match marketing channels to best reach your target audience.

Direct mail. Your mailbox is constantly full because direct mail works! Hyper-targeting lists and messaging go a long way towards saving money and improving ROI. Drive potential customers in your letters and postcards to other owned assets like your website or get them to text for a free offer.

Cold Calling. Cold calling a potential owner from the front of their house is now possible while driving for dollars. With hyper-target lists being smaller in size, it’s easier than ever to hop on a call if you’re great at giving good phone. You never want it to be scammy, spammy, or insensitive. Check out PropertyRadar’s Good Neighbor Marketing Pledge on best practices for marketing and make sure your team is following national and state regulations.

SMS & VMD. SMS text campaigns and voicemail drops have become incredibly popular because of extremely high open rates and low cost. Did you know text messaging has a 98% read rate? Like cold calls, see PropertyRadar’s Good Neighbor Marketing Pledge for ideas on best approaching this channel.

Email Marketing. Email marketing is still one of the most cost-effective and popular communication channels. Refining your lists allows your communication to be hyper-targeted and hyperlocal, making your message less likely to be considered spam.

Digital Ads. PropertyRadar makes custom audiences for Facebook and Google a snap. You can choose primary contacts or even all contacts associated with a property and connect them to a digital ads campaign.

Door knocking. Driving for dollars is an excellent strategy, especially when it begins from a great list. Let PropertyRadar optimize your driving route and then allow the GPS capabilities to follow you as you explore. Only knock on doors that meet your criteria and look like they can use some help. Track pictures and notes within the app and add the property to a separate follow-up list if you make a great connection.

PropertyRadar allows hyperlocal professionals to launch multichannel campaigns smarter and simpler than ever before. Automation makes the process faster.

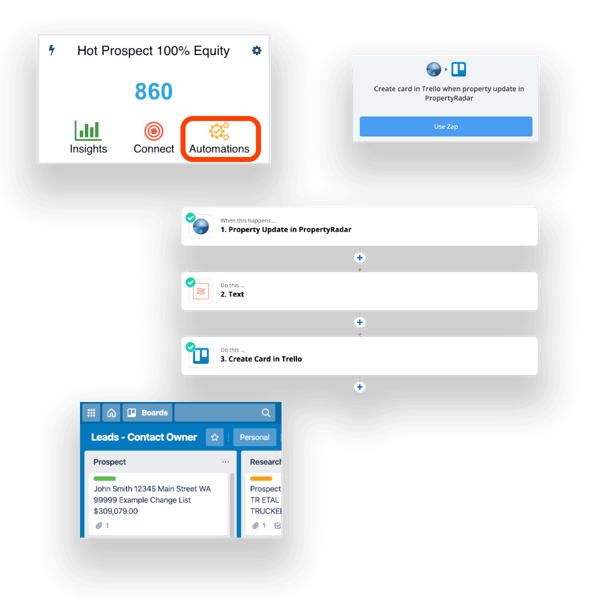

Automate Your Off-Market Lists

If you’ve made it this far, you’re a pro. You’re well on your way to creating your own hyper-targeted and hyperlocal lists. Automations to scale your businesses separate the professionals from the experts. PropertyRadar features in-app automations and connects with over 4,000 best-of-breed marketing and productivity tools via Zapier. You bring your favorite tools, and we’ll automatically keep them filled with your perfect leads.

Build-in Automations

Dynamic Lists go beyond adding and deleting leads based on your preferred criteria. You can be notified by email or within the app when new leads meet your criteria or when a lead has changed status. You can choose to receive updates daily or immediately, so you’re always first in your market to respond. You can choose to mail, email, text, or call leads immediately instead of waiting for mass direct mail campaigns.

Automations with 4,000+ Integrations

Imagine when a new lead meets your criteria, that they automatically push into your favorite CRM system that immediately launches a workflow you’ve carefully designed. Perhaps a personalized letter is sent on day one, followed by a text message three days later, then an email five days after. Automate this process with marketing tools and select print houses. Perhaps you don’t get personally involved until a phone call to the lead on day 14.

While your competitor is juggling outdated lists and archaic campaigns, you’ve already launched a multichannel strategy that best connects with your target audience. You’re not only first, but you’re also the best. And it can all be automated!

Automations are limited only by your tools and imagination.

Four tips to close more off-market deals

- Follow up, follow up, follow up. One outbound message simply isn’t enough, especially with off-market property owners who aren’t necessarily motivated to sell immediately. The most successful businesses are excellent at follow-up. PropertyRadar can provide you with incredible insights and data, but you’ll end up losing to your competitors who don’t give up. Automating your outreach can make follow-up easier to achieve. Part of the benefit of smaller and more targeted lists is more and better follow-up.

- Track your progress. You also need to be tracking your progress with individual prospects. Inside of PropertyRadar, you can do this through custom lead statuses. Using our Zapier integration, you can send all of your PropertyRadar leads into your CRM and track them using a process you design. Popular Zapier integrations include popular CRMs like Pipedrive, Zoho, LionDesk, and many others.

- Use automation. Automating your direct mail and other forms of marketing is essential. Otherwise, you’re at the mercy of getting too busy to market your business to property owners. To win, you need to build highly targeted lists of prospects inside PropertyRadar and use automations to trigger actions whenever new leads get added to your list.

- Take a multichannel approach. Follow-up shouldn’t be in one channel, meaning you shouldn’t only send postcards or only cold call. The best direct marketing campaigns reach out to target audiences across multiple channels.

Key takeaways: Why off-market is a better growth strategy

Finding off-market properties isn’t as challenging with a great data partner like PropertyRadar. The real challenge is using data to find the right off-market opportunities based on your specific criteria and objectives. With PropertyRadar, you can:

- Use 250+ criteria to build your perfect list.

- Use tools like heatmaps, Dynamics Lists, and Insights to better understand and refine those lists for the best targeting.

- Take your hyper-targeted lists and create powerful, personalized marketing messaging that resonates with your audience to help turn those leads into off-market deals.

- Use built-in automations and integrations to automate your workflow and scale your business.

If you’re a professional real estate investor or Realtor® and you’re looking to uncover off-market properties that no one else knows about (yet), then PropertyRadar is the property data and owner information platform you need.