Distressed properties are often great investment opportunities. While finding distressed properties sounds easy, experienced investors know it's not as easy as it sounds. This is why smart investors develop and refine several strategies to stay persistently successful.

Because while physical distress might indicate an opportunity, it’s often only one piece to the investment property puzzle. Finding a property in disrepair doesn’t mean you automatically found a motivated seller. Or further, that you’re the first and only investor to identify and contact that owner of the property.

That’s why curious, data-driven investors look beyond the superficial and dig deeper. They strive to uncover additional, not so obvious, cues that indicate a property owner is in distress and they can be a solution to their problem and make a profit.

These strategies are essential in markets where supply is low, and competition is high. Investors without a disciplined, data-driven focus are at a severe disadvantage. This is why PropertyRadar’s property data and owner information platform is so popular with investors.

|

Looking For Distressed Properties? |

In this article, we aim to uncover the ways successful investors persistently pursue distressed opportunities and consistently close profitable deals. Specifically:

- What Defines A Distressed Property?

- The 4 Cues to Identify Properties in Distress

- The Advantages vs. Disadvantages of Buying Distressed Properties

- The 7 Most Common Ways to Find Distressed Properties

- How To Find Distressed Properties Like A Pro with PropertyRadar

- Qualifying Distressed Properties for Potential Deals

- Closing the Deal - Reaching Out to Owners of Distressed Properties

- Key Takeaways to Finding Distressed Properties and Turning Them Into Done Deals

Side note: While this article is focused on investors, smart Realtors® can easily appropriate these strategies to drive listings or assist investors with transactions.

What Defines A Distressed Property?

Simply put, a distressed property is a property, or home, where the owner can no longer keep up with the financial or physical costs of owning the property.

Typically, these homes are on the brink of, or in the process of, going through foreclosure by the lender as a result of unpaid mortgage payments or tax liens.

It’s not uncommon for owners who are in this kind of financial distress to neglect their homes and let the properties fall into disrepair, especially if the property isn’t their primary residence.

While a house in disrepair is the first cue people think of when they think of distressed properties, it’s only one of several cues. And often, it’s not even the best cue to follow.

4 Cues to Identifying Properties in Distress:

Physical Cues

Physical cues are often an obvious sign that a property may be in distress. If the property has been neglected because the owner lives out of state, is too old to manage the upkeep, and/or is simply tired of paying to maintain the property, you might have an opportunity to relieve the homeowner of the property, and thereby the stress it’s causing them.

That said, distressed owners are often not always ready and willing to sell their property. Whether the property owner cares or not, telling them you noticed the property is in disrepair is not a good strategy to use when approaching the owner of a property.

And if the owner is going through foreclosure, they may be defiant as ever and unwilling to sell the property at that moment. Proceed with caution and more importantly, be respectful and understanding of the owner’s plight. Nobody dreams of buying a property and then being forced to sell it or have it taken away from them.

Life Event Cues

Life events like death or divorce can be a sign of a distressed property. When homeowners get older, they sometimes lose the ability to keep up with the financial burden of owning their homes. Likewise, if there is a messy divorce on the horizon, homeowners may decide to wash their hands of jointly owned properties.

Keep in mind that these are life-altering events that people are dealing with. Again, proceed with caution. If you come off too eager and without empathy, you can easily turn the owner(s) off. They may know they need to sell, but who wants to sell to someone who makes it obvious they’re aiming to profit from someone else’s loss and misery.

Transactional Cues

Investors often use historical sales data to identify real estate investment opportunities. In this case, the property’s most recent sale price, especially in relation to its current income-producing capability and the current value, can provide some insight into whether or not the homeowner needs to sell.

In particular, if the homeowner paid too much for the property when they purchased it, it could be a sign that they're struggling to stay above water.

Debt-Related Cues

Similar to the sale price, the monthly mortgage payment on a property can tell you if it's producing income or if the owner is losing money.

Since a pre-foreclosure property or foreclosed property is the very definition of a distressed property, debt-related cues can often be the most telling sign of a distressed property and an owner willing to have you help them solve their problem.

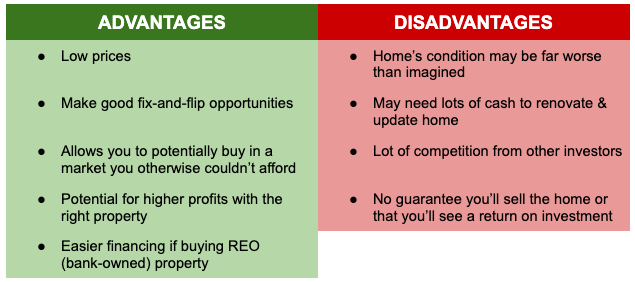

Advantages vs. Disadvantages of Buying Distressed Properties

Now that you have a better idea of what a distressed property is, let’s go over the advantages and disadvantages of buying distressed properties.

Take careful note of the disadvantages as they are typically what trips up investors in closing deals.

7 Most Common Ways to Find Distressed Properties

If you've decided that going after distressed properties is the right choice for you, the next thing you’re likely wondering is how to actually go about finding distressed properties.

Below, we've listed the seven most common methods for finding distressed properties.

1. Driving for Dollars (D4D)

Driving for dollars is exactly as the name suggests. Driving for dollars involves driving around your neighborhood, looking for houses that are in disrepair and therefore might qualify as a potential lead for your distressed property list.

Obvious signs of property in distress would be:- Peeling, faded, and degraded paint

- Overgrown yard with weeds sprouting through concrete cracks

- Broken windows, shudders, rain gutters, etc.

- Shoddy roof, garage door, fence, etc.

- Multiple notices on door, windows, mailbox

- Uncollected mail and newspapers

Obviously, there’s a degree to the distress and disrepair a property can be in. Over time, your experience will help guide you in determining which properties are worth pursuing and which are not.

2. Distressed Property Websites

If you'd rather look for investment opportunities from the comfort of your own home, consider visiting one of the many distressed property websites that are available to anyone with an internet connection.

While these websites make it easy to find investment opportunities, ask yourself this, 1) how fresh is the information, and 2) if anyone can access this information, how many dozens, hundreds, or more investors will you be competing with to buy one of these properties?

3. Local Auctions

Local auctions are also another option for finding distressed properties. Typically, real estate auctions are where lenders attempt to sell distressed properties to the highest bidder. This is the point at which time the distressed homeowners have been trying to avoid.

Keep in mind that auctions typically do not allow investors to finance the property. So, when going this route, you’ll likely need to have cash on hand.

And you can be sure that buying distressed properties at auctions isn’t as easy as bidding higher than the next person. Real estate auctions present their own unique challenges.

4. County Tax Records

Searching county tax records to find distressed properties that fit your criteria is another option. In general, delinquent tax records tend to suggest that the homeowner may be underwater.

If nothing else, when a homeowner can’t pay their taxes, there's a good chance that they are behind on their mortgage as well, which makes them a likely candidate to be a distressed property owner.

5. Court Records

When you're ready to find out if the homeowners have delinquent mortgage payments, you can find this information in county court records. As you might suspect, delinquent mortgage payments are the primary sign that a property is in distress.

Obviously, homeowners who are behind on their mortgage payments are the most likely to fear foreclosure. With that in mind, they may be willing to sell their property at a discount in exchange for you taking it off their hands.

6. News / Obituaries

Another avenue to find distressed properties is watching the news and/or keeping an eye on the obituaries. While it may seem a little strange (even a little macabre) to formulate your lead generation strategy around estate sales, it’s done, and often with surprising success.

That’s because people in charge of disbursing an estate are often motivated sellers. For a variety of reasons, the executor’s ultimate goal is to sell the property and sometimes as quickly as possible –even at well below market value. In which case, they may be willing to give you a deal if you are willing to help them move towards that goal.

7. Code Enforcement

Homeowners who are financially underwater often can’t keep up with the financial burden of maintaining their property. These properties are often subject to code violations. The violations can be minor or serious enough to result in building condemnation.

That said, the municipality's local Health Department or building department usually keeps a list of these properties. In some cases, they will provide this list upon request.

Now, of the seven options discussed above, none is superior to the other. They all come with their own set of pros and cons and unique challenges. Depending on your investment strategy, you may find one works better for you than the others.

One thing you can be sure of, however, is that any of these as a standalone tactic is hard to scale without access to organized, structured data. Moreover, access to multiple tactics as well as the cues can put you in a position to find and qualify the potentially best investment opportunities and turn them into deals.

That’s why using PropertyRadar to find and contact owners of distressed properties is the data-driven, professional way to grow your business.

How To Find Distressed Properties Like a Pro with PropertyRadar

If you want to spend less time driving around looking for distressed properties; less time visiting local government offices and researching various websites to see if a homeowner is financially distressed, and you’re ready to spend more time finding distressed properties worth pursuing, then PropertyRadar makes sense.

That’s because PropertyRadar has data and insights for millions of properties and property owners. And with an industry-leading 200+ filtering criteria, you can build 5, 10, 50, or more segmented mailing lists for your marketing campaigns.

|

Looking For Distressed Properties? |

Watch how PropertyRadar makes it easy to find and build lists of opportunities and potential deals:

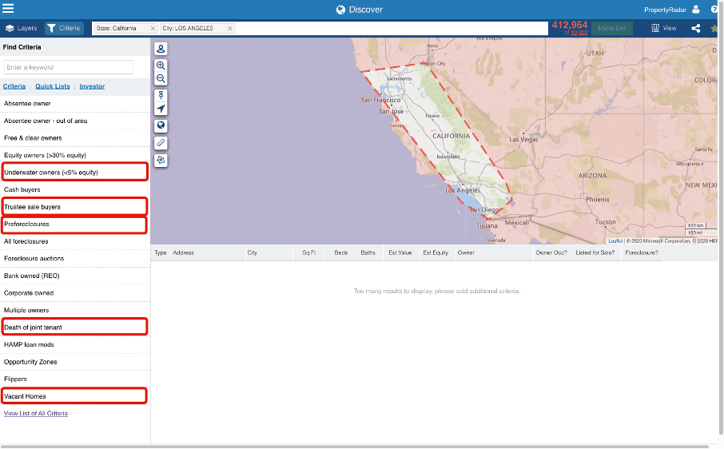

Of course, the challenge with so much data at your fingertips is where to start. That’s why PropertyRadar created Quick Lists. These prebuilt mailing lists include predefined criteria and, in most cases, all you need to do is add the location you’re interested in and you’re good to go.

Take for example the Investor Quick Lists. Here you’ll find a number of Quick Lists that are tailor-made for locating various types of distressed properties. Below we point out a few of those Quick Lists to start with:

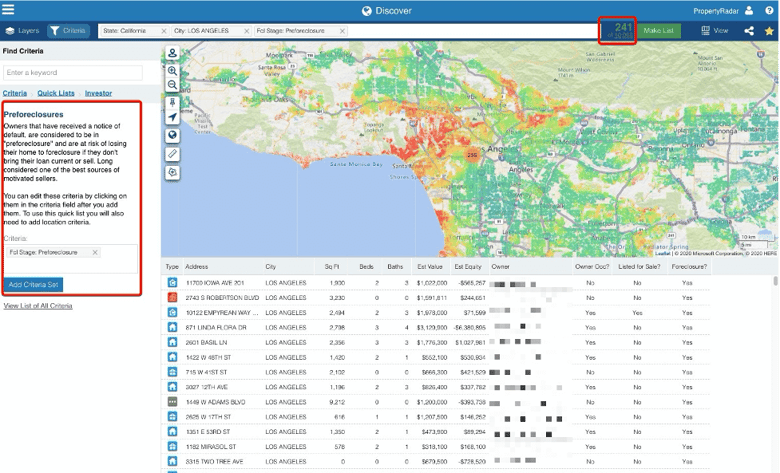

Let’s take a look at Pre-foreclosures in Los Angeles, CA. To do so, you’ll add the Pre-foreclosure Quick List as your first criteria, then add your location of interest, and you’ll see something like this:

In the example above, we discovered 241 properties that qualify as pre-foreclosures.

You can make this a list by simply clicking the big green button at the top of the screen that says, ‘Make List’ and you’re done. Now, refining this list by segmenting it is easy. Simply add ‘Vacant Property’ and/or ‘Absentee Owner’, or whatever other criteria to help you identify your perfect opportunity profile.

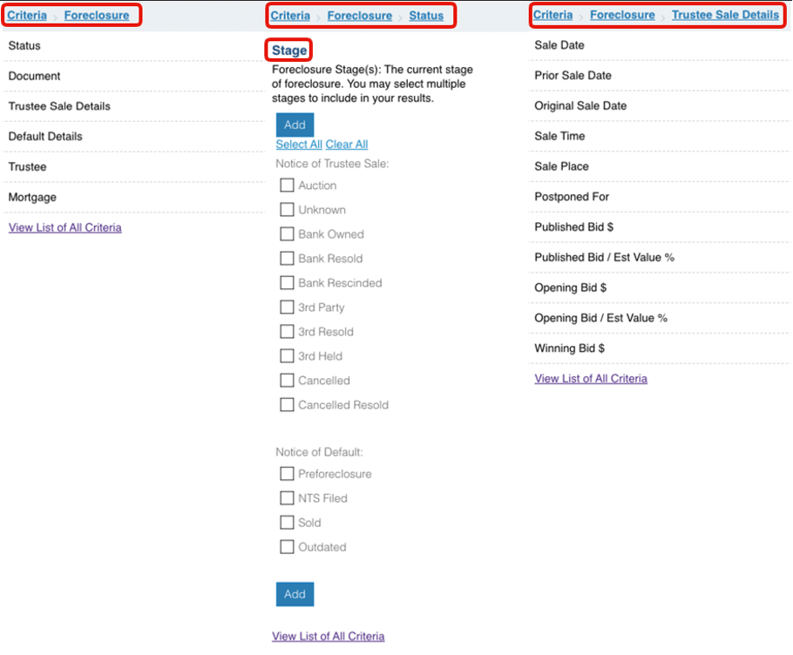

If you’re a seasoned investor, you’ll enjoy targeting distressed properties based on a number of foreclosure criteria, like Foreclosure Stage and Trustee Sale Details.

Again, with over 200 criteria, you can mix and match your data to discover and build all kinds of distressed property lists. The possibilities are practically endless.

But as any discerning investor knows, there are additional details about a property that can reveal whether or not it’s worth pursuing. Once you’ve got your lists, it’s time to dig into the details.

Qualifying The Deals – The Devil's in The Details

Once you have a list of distressed properties based on specific criteria, it's time to qualify them to make sure they’re worth pursuing. This is where reviewing the details of your properties is key to making sure you don’t end up spinning your wheels. Because what may look to be a can’t miss a deal on the surface at first, could end up being an unmitigated disaster down the road.

Fortunately, PropertyRadar makes it easy for you to dive deep and uncover those details. With each property, you get critical info and data about the properties and property owners.

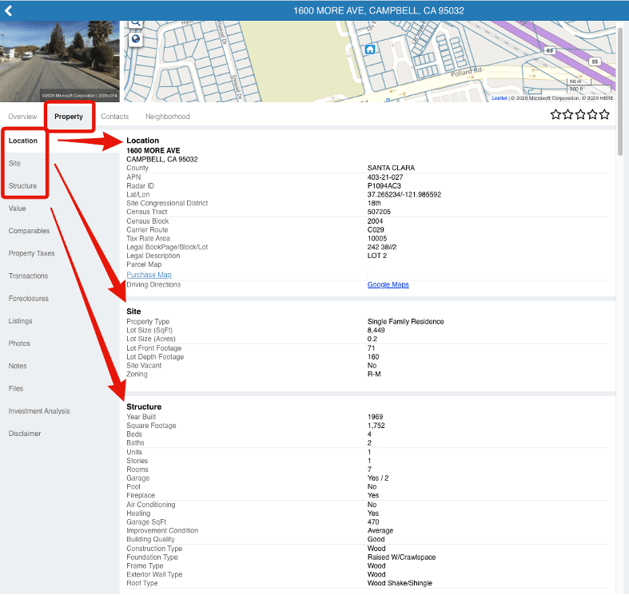

Review Property Details

As mentioned above, the first thing to do is review the property details. Check the property location, the square footage, the number of bedrooms and bathrooms, if it has a pool, or whatever is important to you. Make sure that you're familiar with the characteristics of the property itself before you get into the nitty-gritty of looking over the foreclosure details.

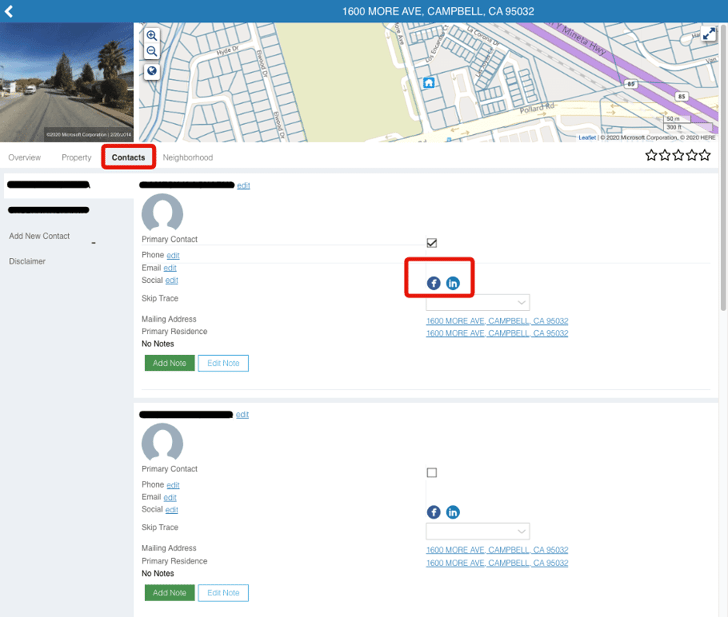

Research Owner Details

Often, you get access to the owner’s social media profiles. Check them to see if the property owner is actively talking about selling their property or if they’ve said anything that indicates they’ll need extra convincing to sell their property.

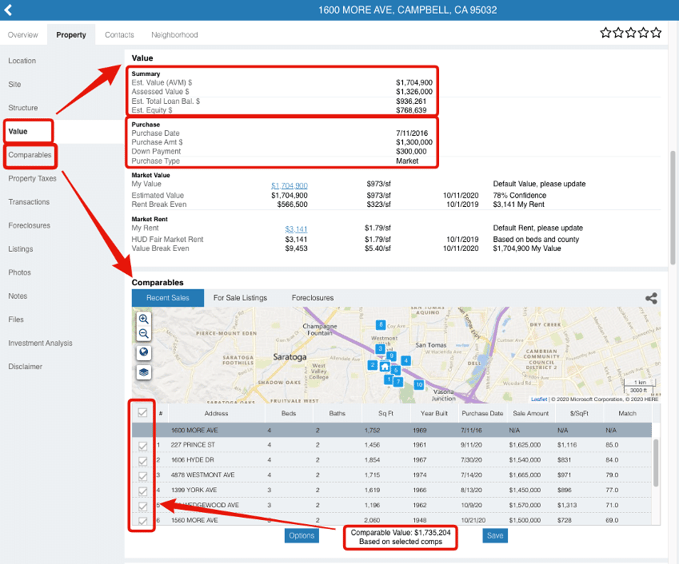

Look at Value (current loans & equity) and Comparables

Review the debt and equity. In this case, “debt” is the measure of any open loans that the homeowner has against the property. The “equity” is the measure of what percentage of the property they own outright.

Comparing the owner’s debt to equity will give you a better idea of how much they owe on the property and how much you may have to offer in order to submit a winning bid.

Review comps in the area to get a better idea of what similar homes are selling for. This can help inform the offer you present.

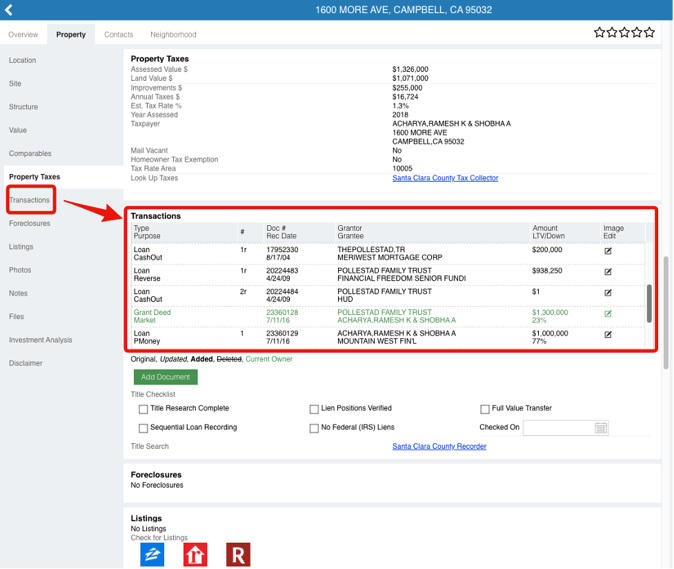

Review Title History for Issues That Might Prevent a Sale

Title issues can create all kinds of problems and headaches. If you’re not careful and rush to buy what on the surface looks like an amazing deal, you could be buying months of headaches that end up killing your profit margin and even putting you in the hole.

Typically, homes sold through the foreclosure process don’t afford investors an opportunity to conduct title searches or buy title insurance before taking over ownership. If there’s a lien or judgment on the property, you could be in for a rude awakening.

With that in mind, be sure to do your due diligence before you make a bid on the property. Dealing with title issues can get expensive. And if you’re a newbie, it’ll likely turn you off to real estate investing forever.

Checking for Recent Sale or Listing

If you find a property that was recently listed or sold, you may be able to get some idea of what the homeowners were expecting in terms of a list price. At that point, you may also have to double-check whether there have been any offers on the property or if the property is currently in the process of becoming a short sale.

Closing The Deal - Reaching Out to the Owners

So, you’ve got lists of distressed properties. Now what? Well, now it’s time to reach out. And how you do that is entirely up to you. The important thing is to remember who you’re reaching out to.

You’re reaching out to people who are in distress and your messaging should come off with empathy and sincerity. You offering to help them out of their sticky situation, NOT to take advantage of them. It should always be a win-win.

Once you’ve got a message that you know works, it’s time to take your direct mail marketing success to the next level. This is how you do it with PropertyRadar:

- Build Mailing Lists with Superpowers – PropertyRadar’s dynamic mailing lists, can automatically:

• Update themselves with new leads and opportunities

• Trigger single piece mailers or multi-touch, multi-channel marketing campaigns

• Alert you to new leads via push notifications or emails (before your competitors even know they exist)

- Autofill Your Pipeline with Leads – Automatically import high-quality leads from PropertyRadar into your CRM, productivity, and project management tools using Zapier integrations.

- Use Automation - Automating your direct mail and other forms of marketing is absolutely essential. Otherwise, you’re at the mercy of getting too busy to market your business to property owners. To win, you need to build highly targeted mailing lists of distressed property owners inside of PropertyRadar.

- Take a Multichannel Approach - Your follow-up shouldn’t be in one channel, meaning you shouldn’t only send postcards or only cold call. The best direct marketing campaigns reach out to audiences across multiple channels. With our PRINTGenie integration, for example, you can simply use their multichannel campaign templates to send a letter, followed by an email, then a text, and a postcard. Watch the webinar here.

- Follow Up, Follow Up, Follow Up - One outbound message simply isn’t enough. The most successful investors and agents are excellent at following up – not giving up after one mailer. You’ll lose to competitors who just don’t quit. And the best way to ensure you automatically, continuously follow up is by setting up marketing automation.

PRO-TIP: Check for Common Interests

The easiest way to connect with someone is by talking about a common interest. We all like to talk about the things we’re passionate about and interested in and connecting with prospects in this way helps build trust.

Fortunately, PropertyRadar lets you discover owners who have shown interest in certain hobbies and subjects. A few examples include:

- Art/Culture

- Auto

- Aviation

- Cooking/Food

- Golf

- Movies

- Pets

- Politics

- Travel

- More

The more information you have about a property and the property owner, the better chance you have of turning an opportunity into a hot lead, and eventually a done deal.

What to Say When A Prospect Calls

Whether you’re cold calling homeowners or a prospect calls you after receiving your mailer or text, how you communicate with them is critical. You can’t come off pushy and too eager to get the deal done.

Remember, it’s about how you’re going to help them out of a particularly tough situation. In the case of distressed properties, it's a matter of taking the property off their hands so that they can be free of the financial burden. Often, a distressed property is an off-market property because the owner is resistant to sell until the bitter end.

With that said, you're also going to want to write out a cold calling script to use with these leads. Take some time to write out what you’ll say, to practice it, and to get comfortable before you start sending out mailings. When a prospect calls you, whether it's your first call or 100th, you want to come off as a professional that's helped countless other people in sticky situations.

As the leads come in, keep track of what responses work with your prospects and tailor your script accordingly.

Key Takeaways to Finding Distressed Properties and Turning Them Into Done Deals

Investing in distressed properties can make for great, highly profitable deals. But if it were as simple as finding homes in disrepair and making an offer to the owner, everyone would be doing it. To that end, remember these important takeaways:

- Identify the 4 distressed property cues: Physical, Transactional, Debt-Related, and Life Events

- Use one, or a combination, of the 7 ways to find distressed properties

- Save time & money using PropertyRadar to find distressed properties and scale your business

- Qualifying the deals – make sure you understand what you’re getting into

- Reach out, follow up, follow up, and oh yeah, follow up again for the win

Again, these strategies are essential in markets where supply is low and competition is high. Investors without disciplined, data-driven focus are at a severe disadvantage.

But armed with PropertyRadar’s property data and owner information platform, you’re ready to take your distressed property investment strategy to the next level, then start your free trial of PropertyRadar today.

|

Looking For Distressed Properties? |