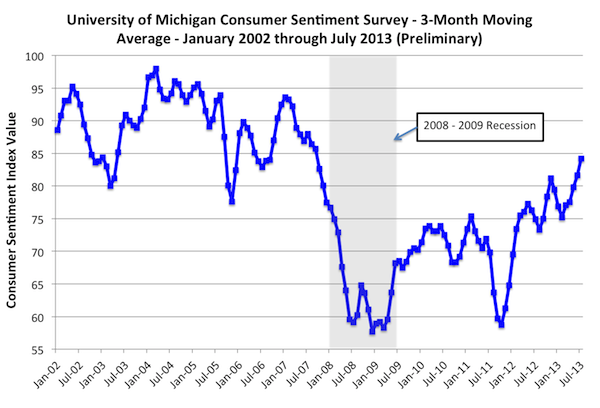

Three-Month Average University Michigan Consumer Sentiment Index Hits 5-Year High

The three-month moving average of the Thompson Reuters/University of Michigan Consumer Sentiment Index, one of the most highly respected and widely watched of the consumer sentiment indices, hit a 5-year high in July. In addition, the consumer expectations index, a measure of what consumers expect in the future, also hit a 6-year high.

The preliminary July sentiment index value was nearly unchanged from June, edging down a scant 0.2%. The slight decline was due to elevated consumer uncertainty about the direction of interest rates but did not derail the longer-term upward trend.

Since February, the three-month moving average of the sentiment index has been marching steadily higher, suggesting that consumers are feeling better about overall economic conditions, their personal finances and willingness to spend.

That's good news for the housing market. Confident consumers are more likely to jump into the housing market to buy or sell if they are feeling good about the economy and their personal finances.

Source: University of Michigan

About the University of Michigan Survey of Consumers (Taken From the University of Michigan Website)

The Surveys of Consumers are conducted by the Survey Research Center, under the direction of Richard T. Curtin, at the University of Michigan. Founded in 1946 by George Katona, the surveys have long stressed the important influence of consumer spending and saving decisions in determining the course of the national economy.

The Surveys of Consumers have proven to be an accurate indicator of the future course of the national economy. The Index of Consumer Expectations, produced by the Surveys of Consumers, is included in the Leading Indicator Composite Index published by the U.S. Department of Commerce, Bureau of Economic Analysis.

The inclusion of data from the Surveys of Consumers by the Commerce Department is a significant confirmation of its capabilities for understanding and forecasting changes in the national economy. Each series included in the composite Index of Leading Indicators is selected because of its performance on six important characteristics: economic significance, statistical adequacy, consistency of timing at business cycle peaks and troughs, conformity to business expansions and contractions, smoothness, and prompt availability. No other consumer survey meets these rigorous criteria.

The Index of Consumer Expectations focuses on three areas: how consumers view prospects for their own financial situation, how they view prospects for the general economy over the near term, and their view of prospects for the economy over the long term. The Expectations Index represents only a small part of the entire survey data that is collected on a regular basis.

Each monthly survey contains approximately 50 core questions, each of which tracks a different aspect of consumer attitudes and expectations. The samples for the Surveys of Consumers are statistically designed to be representative of all American households, excluding those in Alaska and Hawaii. Each month, a minimum of 500 interviews are conducted by telephone from the Ann Arbor facility.

The core questions cover three broad areas of consumer sentiment: personal finances, business conditions, and buying conditions. Overall assessments of past and expected changes in personal finances are supplemented by measures of the expected change in nominal family income, as well as expected real income changes. Attitudes towards business conditions in the economy as a whole over the near and the long-term horizon are measured in detail. Specific questionnaire items concerning expected changes in inflation, unemployment, and interest rates, as well as confidence in government economic policies, supplement the more general assessments. Finally, several questions probe for the respondent's appraisal of present market conditions for large household durables, vehicles, and houses.