The New Property Report - March 2013

Market Activity

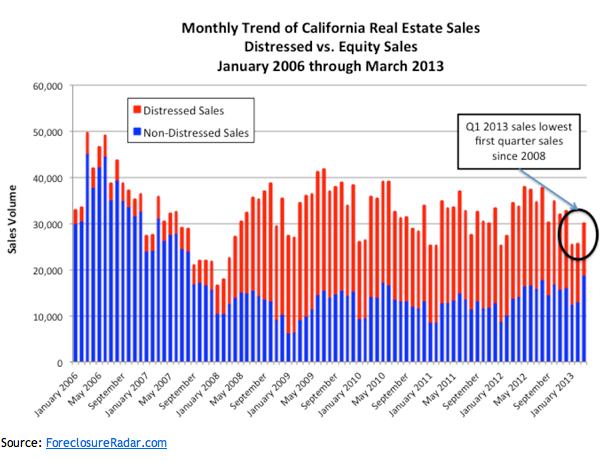

March 2013 California real estate sales – the sum of distressed and non-distressed property sales – fell 12.9 percent year-over-year. Some of the decline this year is likely due to the roving Easter holiday that landed on March 31 this year and April 8 last year. Over a longer time period, however, Q1 2013 sales are still at their lowest since 2008.

In addition to an overall downturn in sales, the mix of properties for sale in March changed markedly. When sales are divided into distressed and non-distressed sales, non-distressed sales increased to 62.9 percent of total sales in March 2013, up from 48.8 percent and 50.8 percent in January and February 2013, respectively.

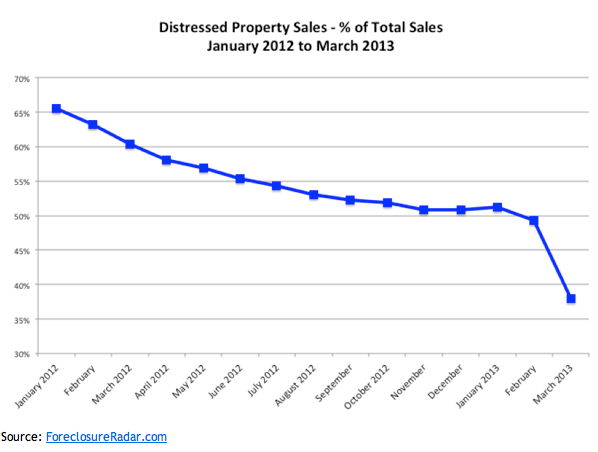

Since January 2012 of 65.5 percent, distressed property sales as a percent of total sales gradually declined to 48.8 percent in February 2013. While still a large portion of the market and nearly four times the pre-housing crisis average, distressed property sales in March 2013 saw a sharp decline to 37.1 percent of total sales.

Source: PropertyRadar.com

REO resales declined from 24.5 percent of total sales in February, to 13.8 percent of total sales in March. The decline in bank REO resales is perplexing and we are conducting further research to determine the root cause.

Source: PropertyRadar.com

Homeowner Equity

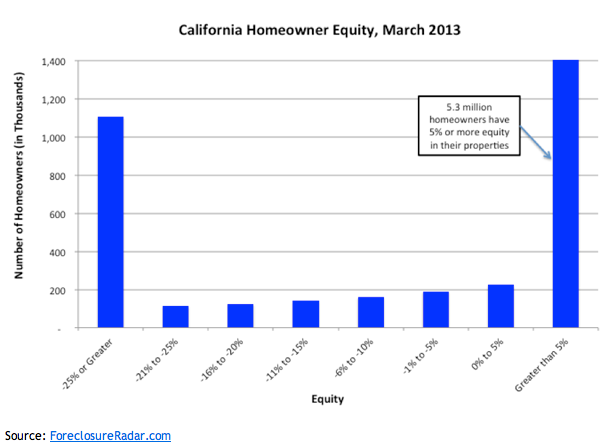

The severity of the housing market crash left huge numbers of California homeowners owing significantly more than their homes were worth. Underwater homeowners can neither sell their existing home nor buy another home, removing this important segment of the housing market from either contributing to housing inventory for sale or becoming potential buyers.

As of March 31, out of 7.3 million California homeowners with a mortgage, 1.8 million were underwater. Another 225,000 homeowners had 5 percent or less equity in their properties. We define this group of homeowners as “near negative equity” and include them in the analysis because costs associated with the sale of a home typically amount to 6 to 10 percent of the sales price leaving these homeowners effectively underwater. The total of these two classes of underwater homeowners is 2.0 million. Of those 2.0 million underwater homeowners, more than 1.1 million owe more than 25 percent of their home’s value.

Source: PropertyRadar.com

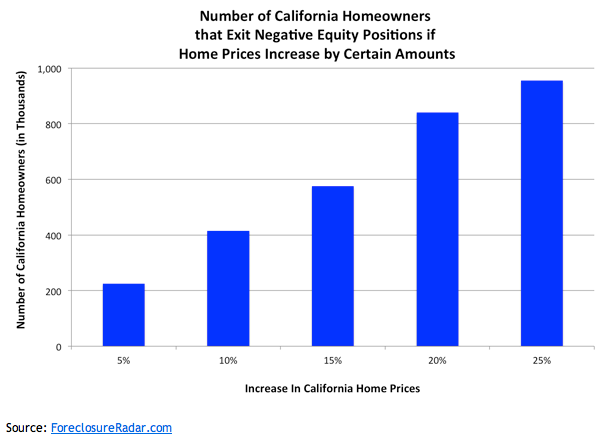

Rising home prices will help lift a certain percentage of underwater homeowners into a state of positive equity and into a position where they could choose to sell. If they choose to sell, these homeowners will help alleviate some of the current inventory problems, while also increasing sales activity.

If home prices increase 10 percent, an estimated 415,000 homeowners, or 23 percent of negative equity homeowners, will be returned to a positive equity state. In addition, if home prices rise 20 percent, an estimated 715,000 homeowners, or 40 percent of negative equity homeowners, will transition to a positive equity state.

Source: PropertyRadar.com

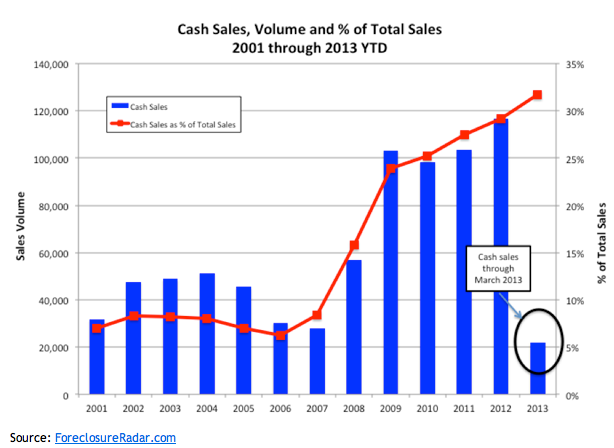

Cash Sales

Since 2008, total cash sales have increased dramatically. From 2001 through 2007, cash sales ranged from a low of 27,381 to 51,387 per year and represented only 6.2 percent to 8.4 percent of total market sales. In 2008, as the housing market collapsed and prices plummeted, real estate investing became more attractive and cash buyers returned to the market. In 2008, cash sales were 57,019, or 15.9 percent of total sales. By 2012, cash sales had swelled to 116,549, or 29.2 percent of total sales. So far in 2013, cash sales are 30.2 percent of total sales. Rising prices make it more difficult for investors to find reasonable returns and therefore this number is likely to decline.

Source: PropertyRadar.com

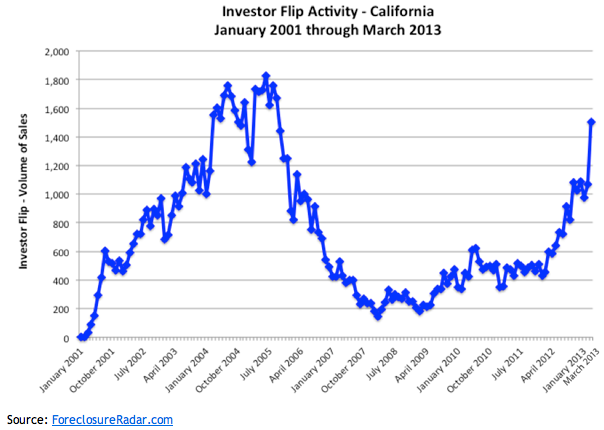

Flipping Activity

In March 2013, flipping — defined as reselling a property within six months — reached its highest level since September 2005. Flipping has steadily increased over the past 12 months due to the increase in profit potential in a market where housing prices are on the rise. In 2011, as housing prices trended sideways, flipping was also basically flat, ranging from a low of 1.4 percent of total sales in January, to 1.6 percent of total sales by December 2011. In 2012, flipping began to increase and over the course of the year nearly doubled, rising from 1.7 percent of total sales in January 2012 to 3.3 percent of total sales by December 2012. Since the beginning of 2013, despite the fact that overall real estate market activity has been flat to down, flipping volume continues to rise because of attractive housing price gains. As of March 2013, flipping reached 5.2 percent of total sales, and sales activity was nearly triple from March 2012.

Source: PropertyRadar.com

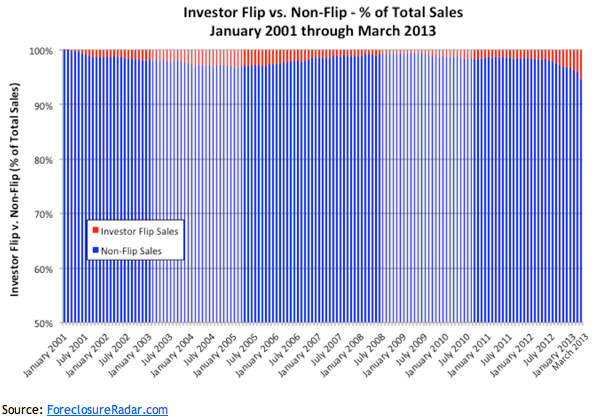

Even with the increase in flipping activity that does play a role in cleaning up the derelict property, they are such a small portion of total sales that they have no impact on overall market prices.

Source: PropertyRadar.com

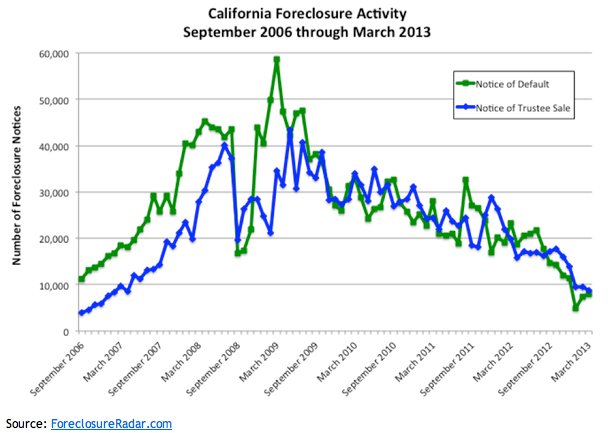

Foreclosures

California foreclosure filings have been on a steady downtrend since March 2009 as government agencies have rolled out an ever-increasing array of programs that have successfully lengthened the foreclosure process or provided alternatives such as short sales, and principal balance reduction loan modifications, second-lien extinguishment, and other forms of debt relief.

California foreclosure filings — Notices of Default plus Notices of Trustee Sale — increased 4.0 percent in March, but were down 59.3 percent in the past 12 months.

March Notices of Default (NOD), the first stage of the foreclosure process, rose 9.5 percent from February. More importantly, NODs are up 65 percent since January, suggesting that some of the regulation-driven decline in foreclosures toward the end of last year has reversed course. While the gain since the beginning of the year was large in percentage terms, the longer-term downtrend has held firm. The March 2013 NODs were at their third-lowest level since we began tracking the data in September 2006. Over the past 12 months, NODs were down 65.3 percent.

Source: PropertyRadar.com

Madeline's Take - Director of Economic Research, ForeclosureRadar

A day doesn’t go by without a headline trumpeting the news that the California housing market is in recovery. The most common piece of evidence cited is the double-digit gain in housing prices over the past 12 months. Proclaiming a housing market recovery based on prices alone is akin to a blind man holding the tail of an elephant and proclaiming it a snake.

Several other factors crucial to a healthy housing market seem to be absent in California:

- Solid income and job growth.

- An increase in housing sales.

- Low levels of negative equity.

While a discussion of income and job growth is beyond the scope of this report, suffice it to say that in California, income growth has lagged inflation since 2008 and the unemployment rate remains painfully high at 9.6 percent.

The other two important factors necessary for the housing market to recover are an increase in sales and sufficient growth in homeowner equity to allow more homeowners to enter the market to sell or buy. As our research has shown, first-quarter sales were at their lowest level since 2008 and more than 1.8 million California homeowners (25 percent of all homeowners with a mortgage) owe more than their homes are worth. These factors will continue to exert a drag on the market by limiting inventory and constraining sales.

If several crucial ingredients are missing from this housing market recovery — income, jobs, sales, much lower levels of negative equity — then why are housing prices rising so quickly? Sean O’Toole, CEO of ForeclosureRadar provides his perspective below.

Sean's Take – Founder/CEO, PropertyRadar

While there are several reasons why California home prices are rising so quickly, the most dominant is government intervention.

Government intervention has significantly distorted the housing market by constraining supply and keeping mortgage interest rates artificially low. While many states that the lack of inventory will cause housing prices to jump 20 percent or more this year, I believe the increase in home prices will be constrained by the availability of credit, appraisals that lag market prices, affordability, and return on investment.

Regardless, near-term prices will continue to rise, and as prices increase return on investment will decline. Therefore, those looking for long-term real estate investment should act quickly.

Regulatory Update

In conversations with legislative analysts at the state and federal level, we’re seeing little expectation of new laws that significantly impact the housing market this year because several major laws affecting the housing market, such as Dodd-Frank and the California Homeowner’s Bill of Rights, are either recently passed or on their way to being implemented. The legislative focus at both the state and national levels has shifted instead to budget issues. At the federal level, the debt ceiling debate threatens to command center stage later this spring and summer.

In California, a lingering question remains about whether the Mortgage Debt Relief Act extension passed by Congress on January 1 will be implemented at the state level. According to our state legislative contact, SB 30 (the California equivalent of the federal Mortgage Debt Relief Act) passed its first policy committee and is now pending on the Senate Appropriations Committee Suspense File (a legislative process that is used to review bills that cost more than $150,000). A decision about whether the bill exits the “suspense file” status should occur in the final week of May.