Market Activity

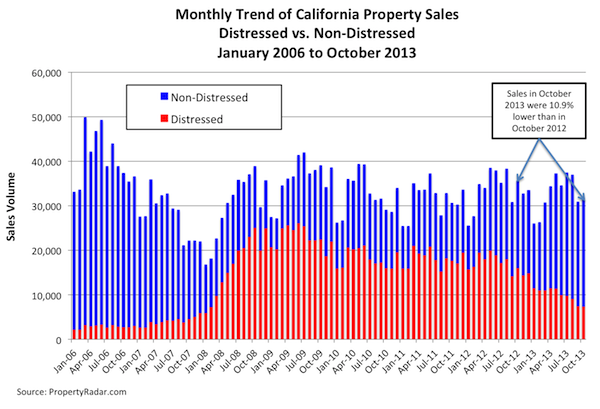

California single-family home and condominium sales increased 2.6 percent in October from September, but fell 10.9 percent from a year ago.

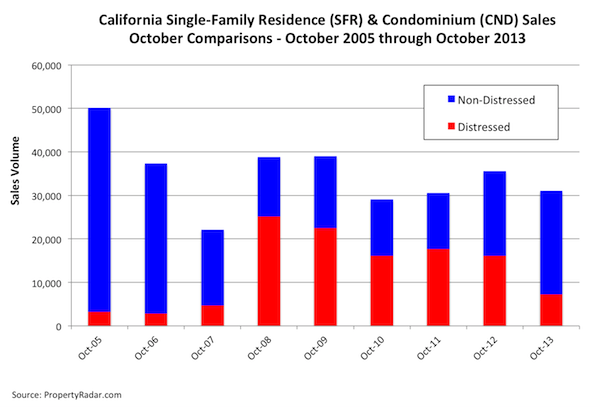

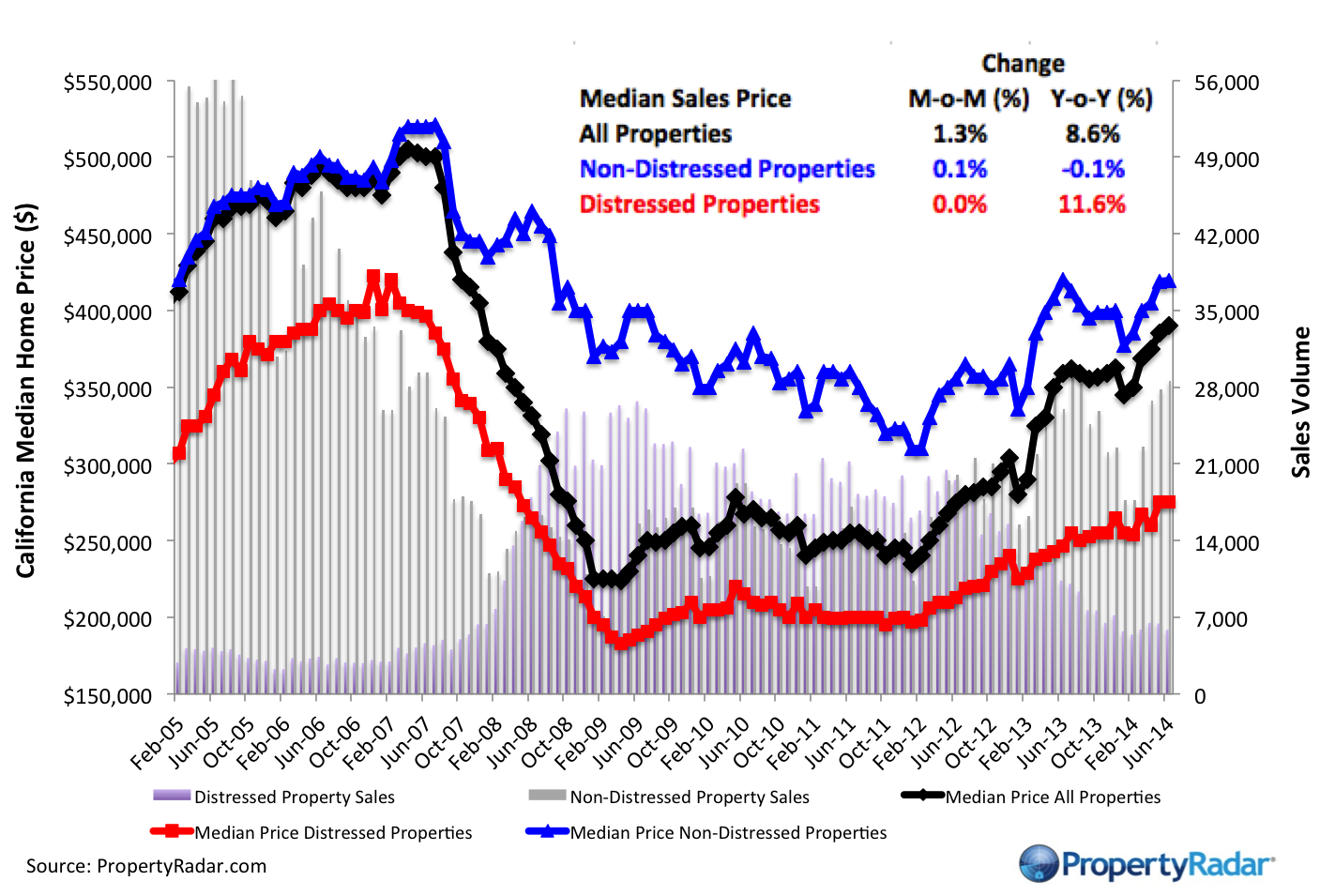

To get a clearer picture of current real estate sales trends and to eliminate seasonal factors, we compare October 2013 property sales to October sales in prior years. Last month’s sales were considerably lower than sales in October 2012. Dividing sales into their distressed and non-distressed components, distressed property sales fell 54.0 percent in the past 12 months while non-distressed sales jumped 24.7 percent. Though distressed property sales declined in October, they still accounted for 23.4 percent of total sales, which is historically high. In eight of California’s largest counties — Fresno, Merced, San Bernardino, Kern, San Joaquin, Solano, Stanislaus and Tulare — distressed properties represented more than than 30 percent of sales; Merced County was highest at 38.4 percent of sales.

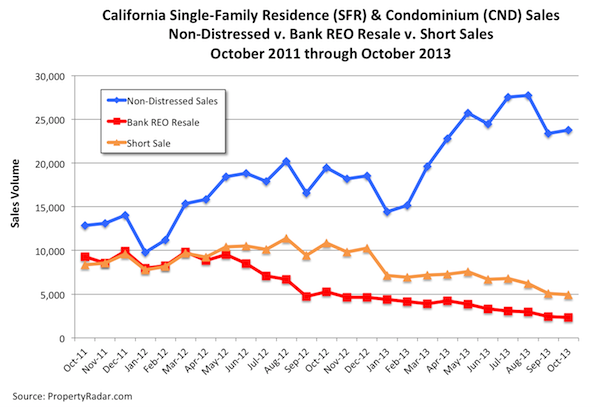

Dividing distressed property sales into short sales and bank REO resales can provide a better understanding of underlying trends. Short sales fell 2.7 percent in October and are down 54.4 percent from a year ago. Also, bank REO resales are down 4.4 percent for the month and down 55.7 percent year-over-year.

Homeowner Equity

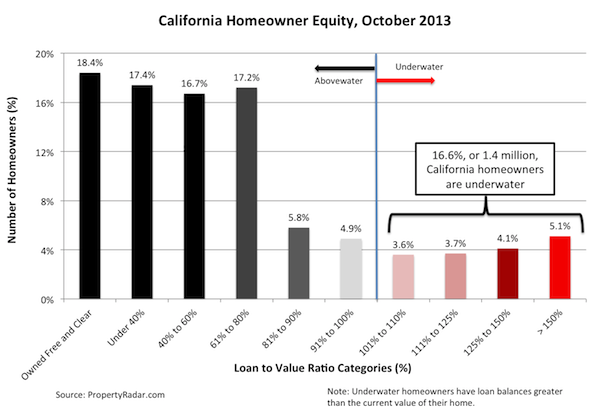

The steady rise in home prices since January 2012 has allowed thousands of California homeowners to shift from being underwater to having positive equity so they can refinance or sell their homes. In the past three months, the number of homeowners with more than 10 percent equity in their homes has increased by 3.4 percent, or approximately 165,000. The number of homeowners who are moderately to severely underwater has fallen by 10.3 percent, or approximately 125,000.

Despite the improvement, large numbers of underwater homeowners remain a drag on the California real estate market. In October, nearly one in five, or 1.4 million (16.6 percent) of California’s 8.4 million homeowners were underwater while more than 414,000 (4.9 percent) were barely above water (less than 10 percent equity in their homes). Since closing costs are 6 to 10 percent of a home’s sale price, these homeowners are effectively underwater. All told, 21.5 percent of homeowners (just over 1.8 million) are underwater or barely above water — and effectively shut out of the California real estate market.

Several of California’s largest counties continue to struggle with much higher levels of negative equity. In Fresno, Kern, Merced, Solano, San Joaquin and San Bernardino counties, 27 to 31 percent of homeowners, or one in three, are moderately to severely underwater.

Median Prices

The median sale price of a California home gained $5,000, or 1.4 percent, to $360,000 in October from $355,000 in September. Median prices have hovered near $360,000 since June. On a year-over-year basis, median prices increased 26.4 percent from $285,000 to $360,000.

Rapid monthly home price increases that typified the California real estate market earlier this year appear to have slowed or reversed course in response to a 100-basis-point increase in mortgage interest rates in June. Despite the slowdown in price appreciation statewide, homes in the Bay Area counties, such as Alameda, Contra Costa, San Mateo, Santa Clara and Sonoma, still experienced solid price appreciation in distressed and non-distressed properties.

Rapid changes in the mix of distressed and non-distressed property sales from 2012 to 2013 continue to influence the year-over-year change in median prices. Distressed property sales plunged from 45.3 percent of total sales in October 2012 to 23.4 percent in October 2013.

The following graph highlights median sales price trends from January 2004 to October 2013. Aggregate single-family home median sales prices are shown in blue, and distressed and non-distressed median prices are shown in red and green, respectively.

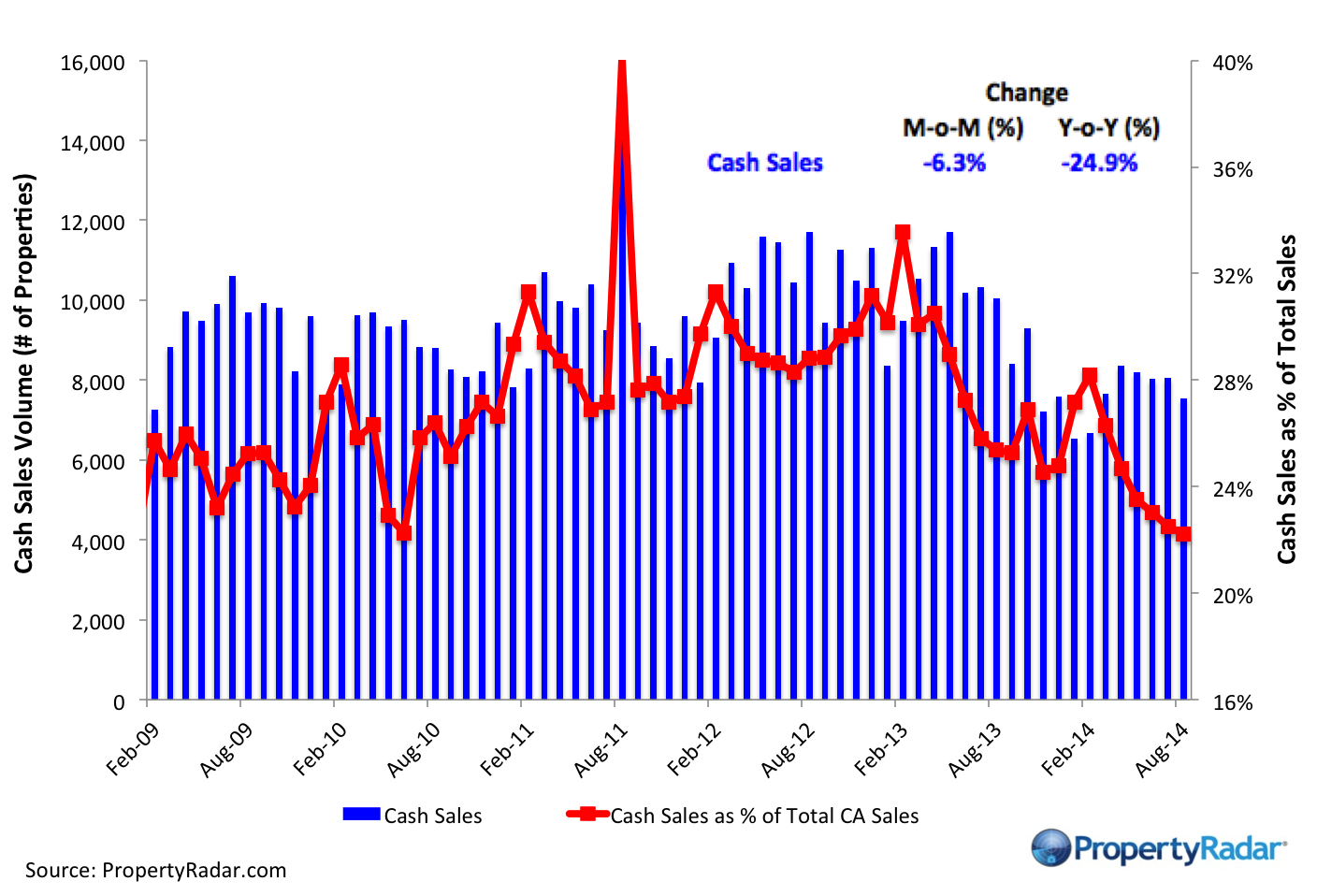

Cash Sales

In October 2013, cash sales represented 23.8 percent of total sales, down 0.6 percentage points from 24.4 percent in September. Taking a longer-term view, cash sales as a percent of sales oscillated between 28 percent and 31 percent from January 2012 through January 2013. They peaked at 33.0 percent in February 2013 and have been below 25 percent since August 2013. From a historic perspective, cash sales remain high and are an important part of the real estate marketplace even though they are now trending lower.

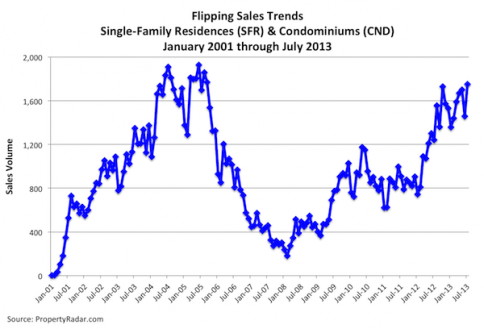

Flipping

October 2013 flipping (reselling a property within six months) gained 9.7 percent from September but was down 10.3 percent from a year ago. Flips represented 5.0 percent of total sales in October, up from 4.7 percent in September and 4.3 percent in August.

Taking a longer-term view, in 2011, as housing prices trended sideways, flipping was basically flat, ranging from 2.5 percent of sales in January to 2.7 percent in December 2011. In 2012, flipping as a percent of sales began to increase, rising from 2.9 percent in January 2012 and peaking in February 2013 at 5.5 percent. Flipping retreated from February 2013 to June 2013, reaching an interim bottom of 4.1 percent of sales. In the past three months, flipping has edged higher because investment returns remain attractive.

In October, flipping as a percent of sales was highest in Fresno, Merced, Sacramento, San Bernardino, San Diego and Stanislaus counties.

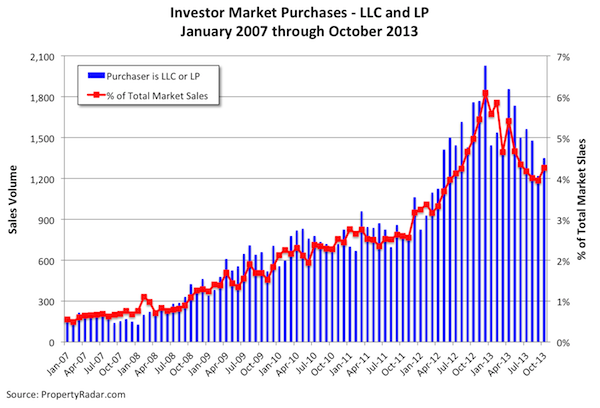

Investor (LLC and LP) Purchases

October 2013 investor purchases retraced much of the 17.6 percent September decline, rising 10.8 percent for the month. Investor purchases are defined as a market or third party purchase at a trustee sale by a limited liability corporation (LLC) or a limited partnership (LP). In general, investor purchases have been trending lower since peaking in October 2012 and are now 33.5 percent below that peak. This is being driven primarily by the increase in purchase prices. As prices rise, the potential return on investment (ROI) for holding properties as rentals decreases, making it less attractive to investors.

Foreclosures

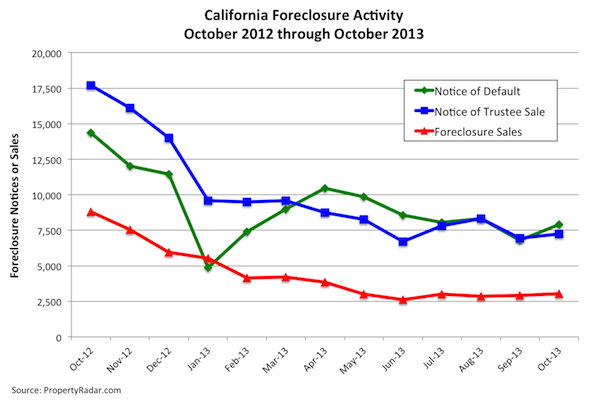

California foreclosure activity – Notices of Default, Notices of Trustee Sale and Foreclosure Sales – edged higher in October but has been trending mostly sideways since June at or below pre-housing crisis levels.

California Notices of Default jumped 15.3 percent in October, retracing some of the 19.5 percent drop in September, but fell 45.2 percent in the past 12 months. Similarly, Notices of Trustee Sale gained 4.1 percent but dropped 59.2 percent for the year. Foreclosure sales gained 3.9 percent for the month but sank 65.4 percent for the year.

Madeline’s Take – Director of Economic Research, PropertyRadar

Last month, I spoke to a couple of real estate groups about their challenges and concerns for the market in the months ahead. The challenge I heard repeatedly was lack of inventory, although the scarcity of properties for sale has eased a bit since summer. The problem is that first-time homebuyers have little inventory to choose from. Move-up buyers, meanwhile, are unlikely to list their homes unless they are assured of having another to purchase.

The challenge to the California real estate marketplace is the more than 1.8 million underwater homeowners who can neither sell their existing homes nor buy another. While the number of underwater homeowners is gradually diminishing, it is still huge by historic standards and will continue to impart a drag on the California real estate market.Finally, on a year-ago basis, October 2013 sales were lower than October 2012 sales suggesting that this summer’s 100 basis point increase in mortgage interest rates is dampening the California real estate market. T

he incoming Federal Reserve chairman, Janet Yellen, is acutely aware of the importance of the real estate market to an ongoing economic recovery and will do everything in her power to keep mortgage interest rates low. In fact, the word on the street is that Yellen will likely keep interest rates low until 2016 or 2017.

Sean’s Take – Founder/CEO, PropertyRadar

With sales down year over year, increasing inventories, and flat to declining median prices the last few months, the question now is whether this is just an off-season lull or a turning point. I’ve seen credible analysts make strong arguments both directions. The reality is that real estate markets are now primarily driven by government intervention, whether it be anti-foreclosure legislation, interest rates, or cost and availability of home loans. As such, to understand where markets are headed it’s more important to look to trends in Washington then what’s happening on the street. On that front we have mixed signals. There continues to be a call for an end to Freddie and Fannie, which regardless of your long-term view, would clearly be disastrous in the near term. On the other hand Janet Yellen is likely to be our next Fed Chairman. Ms. Yellen is perceived to be an uber-dove, who will spike the punch bowl at every opportunity. I’m not sure that’s true, but the perception should help to keep rates low for the foreseeable future. We also have the new Dodd Frank rules coming into effect in January, though heavily watered down thanks to exceptions for the GSE’s. From that, I think the likely forecast is that things will be fairly flat for a while, with the typical seasonal dip in sales volume in January and February and little price movement as both buyers and sellers call each other’s bluff.

Real Property Report Methodology

California real estate data presented by PropertyRadar, including analysis, charts and graphs, is based upon public county records and daily trustee sale (foreclosure auction) results. Items are reported as of the date the event occurred or was recorded with the California county. If a county has not reported complete data by the publication date, we may estimate the missing data, though only if the missing data is believed to be 10 percent or less of all reported data.