How to Get Started in Real Estate Investing

With so many ways to get started in real estate investing, it can get complex and overwhelming fast.

Where do you invest, what inventory should you target, and what real estate investing strategies are the right ones to find the best deals?

This article covers finding a path into real estate investing that leverages the skills you already have and how that translates into real estate strategies to find more deals.

Don’t miss out on the chance to see firsthand how PropertyRadar can supercharge your real estate investment strategy. Start your free trial today!

Why People Succeed in Real Estate Investing

Lack of money, skills, or deals is not why people fail to launch their real estate investing careers. The two main reasons people fail to get started include:

- They never start

- They don't bring themselves to the business

Success can't happen if you never pull the trigger. Binging flip TV shows, listening to real estate investor podcasts, and attending your local investor club isn't enough. Some find themselves in the education loop for years without ever doing a deal, and part of that happens because they make a common error.

Information on real estate investing is everywhere, and there are so many different paths in the industry. It's easy to get distracted by the latest and greatest techniques and technology, but it comes down to aligning efforts with your personality, skill set, and financial position.

Setting yourself up for success from the start requires you honestly answer the following four questions:

- Am I an introvert or an extrovert?

- How much time can I dedicate to the real estate investing business?

- What is my financial position?

- What experience and talents do I bring to the business?

Personality. Understanding your personality is important because specific strategies call for particular skill sets. Some personalities will find some strategies easier to execute than others. Ask an introverted engineer to knock on random doors of prospects, and she may immediately cringe. Ask that same engineer to work on lot splits and development projects and watch her face light up. There are investing strategies that fit every personality type. The goal is to find one that works in the current cycle that has you excited to wake up and be an investor every day.

Time. Many would-be investors don't think about the time it takes to be in the business of real estate investing. 60-minute TV shows make it look far too easy. And some strategies are time-intensive. In markets dominated by distressed real estate, bidding on properties off the MLS or auction sites is easy and can be managed part-time. Launching direct mail campaigns and driving calls to your cell phone when you have a full-time W2 job isn't likely going to work. Be honest about the time you can commit to the business and focus on appropriate strategies that fit.

Money. Many people think you must have money to get into real estate. That's not always the case. However, cash, or access to capital, certainly makes the game easier. It's also essential to understand the appropriateness of specific strategies depending on your risk tolerance and age. If you're over 65 and happily retired, raw land development is probably too risky and creates an unnecessary exposure to your retirement. Instead, passive investing in notes might be a better option. Matching strategy to risk and resources are two important factors.

Experience. The real estate business is open to all, even the inexperienced. The experience referenced here is about the talents you bring to the table. Whatever your work background, chances are you bring skills that transfer perfectly to different investing strategies. It's simply up to you to match that skill set with a strategy or find a partner that helps fill in the gaps.

Clarity around these questions will make executing the following ideas and strategies easier. You can more honestly access which will work best for your current personality, time allotment, financial position, and skills.

Where to Invest in Real Estate?

When committing to invest in an area, most investors want to understand asset pricing, rehab requirements, general economic outlook, population growth, market trends, jobs outlook, and other factors impacting the market. Some real estate investors follow a strict two-hour rule where they can be on-site within a two-hour drive. Others build local teams they trust in distant markets. The location depends on your investing goals and your comfort level.

What Type of Properties?

Many investors stumble into specific asset types in real estate because of family or friends. There's no right or wrong asset type. It's about comfort level, access to the required capital, and the ability to find and close deals in your chosen segment.

Land: Land is a very cyclical investment. Some begin in land because of the low price point. Raw land development, lot splits, and infill projects are some of the strategies in land. In up cycles, land goes for a premium as builders thrive. In down cycles, getting stuck holding land can be an expensive waiting game as you pay for expenses like property taxes and lot clearing with no revenue until the market returns.

Single-Family Properties: Many real estate investors like single-family investing because of availability, price point, ease of financing, and strong consumer demand. The single-family category can also include condominiums, townhouses, and mobile homes.

Multifamily Properties: Multifamily investing involves properties that are two-to-four-unit buildings. New investors can start by purchasing a multifamily building to live in one unit while renting the other units to offset mortgage costs. Furthermore, more states are looking to multifamily to solve affordable housing issues. Growing opportunities are likely in the years ahead.

Commercial: Commercial real estate investing can include apartment buildings, hotels, nursing homes, and mixed-use buildings. Investors in commercial real estate investing tend to be more sophisticated due to larger purchase prices and carrying costs. It is not unusual to have investors start in single-family investing and then gradually grow into commercial opportunities.

Mobile Home Park: Mobile home park investing is a unique commercial niche where investors are often chasing passive cash flow from land leases to mobile home owners within a park. Others focus on creating and managing amenities and improving lot performance. Mobile home park variety and price points are as wide as the single-family category.

Storage: Storage is an attractive industrial opportunity for investors who want to avoid housing people and instead focus on housing stuff. So many new business models have appeared in the last few decades. Massive warehouses storing documents, cold storage, and pods are just a few of the newer opportunities in the space.

Passive Investing: Numerous opportunities await investors looking for checks in the mail instead of needing to market for deals, rehab properties, and dealing with tenants. Examples include private notes and REITs. There are often net worth rules around these investments, and most entering passive investments are familiar with the underlying assets.

How to Find Real Estate Deals

When an investor has clarity on who they bring to the business, has selected a market, and has chosen an asset type, next is choosing the general business strategy. Think of this as your job title on a business card.

Wholesaling / bird dogging: Not all investors want the journey of rehabbing a property. Those with marketing talents may decide to market to off-market sellers directly to then wholesale deals to a list of qualified buyers for a finder's fee. The wholesaler often assigns that property without needing their cash in the deal.

Flipping: Flipping includes finding, fixing, and reselling a property. This business strategy has lots of variety and niches, from light fixers to complete gut rehabs and ground-up construction.

Landlord: Holding and managing real estate is key to wealth creation. Wholesaling and flipping create returns, but another project needs to be in process to keep money coming in. Building a cash-flowing rental portfolio creates consistent cash flow while eventually building a free-and-clear portfolio.

Passive Investing: Not all investors have the time or desire to deal with flipping or being a landlord. Passive investing via partnerships, private notes, or structures like REITs are a few ways to get exposure to real estate without the management headache.

Don’t miss out on the chance to see firsthand how PropertyRadar can supercharge your real estate investment strategy. Start your free trial today!

Basic Steps to Finding Real Estate Deals

Being active as a real estate investor means creating a consistent pipeline of deals. Let's explore details into discovering deals, how to find the owner of a property, understanding how to create niches your competition misses and connecting effectively to potential on- and off-market sellers.

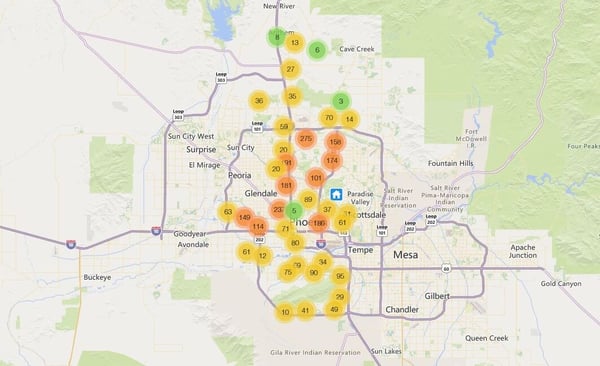

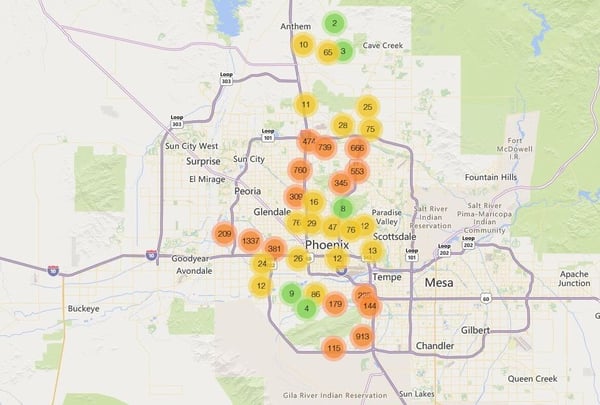

Market Research: When you select an area and property type, identifying local investors helps you understand popular areas for flippers, target inventory, and the level of rehab to maximize profits. Below is a map of flippers in Phoenix, AZ over the past 365 days.

This map shows where flippers are most active. Switching to a list view allows you to explore local flippers by name. Phoenix happens to be a hot market for Wall Street and Main Street investors alike.

It's easy to drill down to identify what they buy, the price point, property features, and more. A faster approach is simply adding the 3,100 flips to a list in PropertyRadar with insights turned on to drill down into trends.

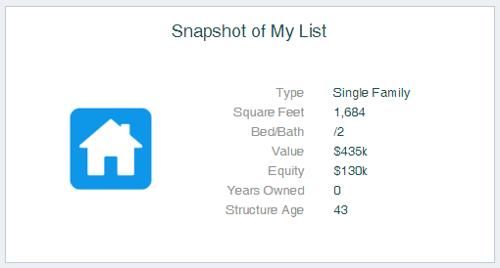

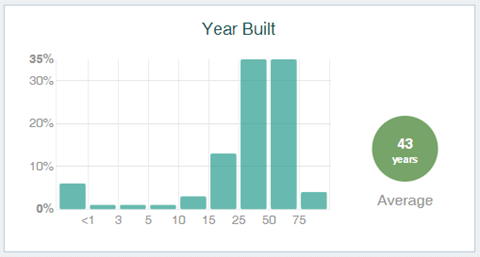

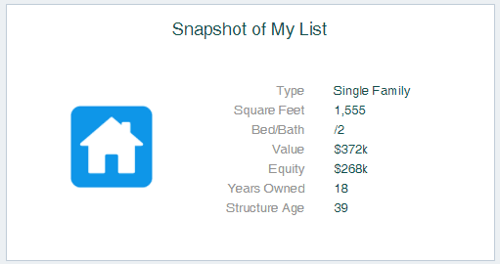

The snapshot view shows us that flippers in Phoenix target properties around 1,700 square feet that are around 43 years old with a value of $435,000. Beds do not show because Maricopa County does not track bedrooms in public records. Every county approaches data and public records in different ways. Local flippers have the advantage as they will be more familiar with inventory compared to out-of-town investors.

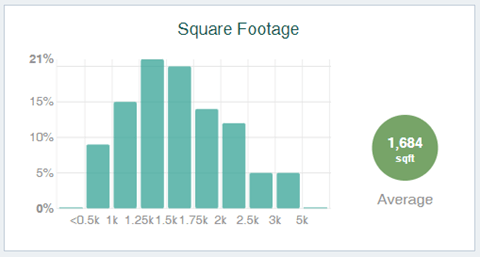

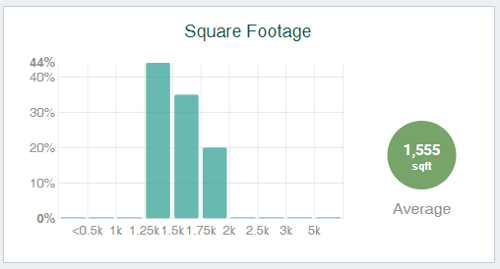

Looking further into property-centric insights, local investors flip properties that tend to be under 2,500 square feet, but most are 1,250-2,000 square feet is the most popular range.

We can tell by the year-built data that most flippers target properties 25 to 75 years old. Newer properties require less renovation and a deep discount is unlikely since the buyer would net more by listing with a local agent. The Phoenix market is also a hot market for ibuyers that strategically target newer properties that need little work, so competition is steep. Properties over 50 years typically require significant renovations, which Wall Street players avoid.

Armed with this information on specific areas and property details, an investor has one of three decisions to make:

- Compete: Knowingly compete against the same inventory

- Sell: Target deals with property or people issues the competition avoids, fix the issue, then wholesale the property to the competition (now customer)

- Create: Target areas or property characteristics the competition is actively chasing

Discover: In the discovery phase of research, you take the market analysis and carry it over into list building. Competing with local flippers is easy since we've uncovered the area and target property characteristics. Any list service will happily sell you a list of Phoenix, AZ properties that are between 1,250-2,000 square feet on properties that are 25-50 years old. However, the minute you buy the list, it becomes stale. It's also large, with over 68,000 properties. There are over 250 criteria investors can use to build a better-targeted list. Popular criteria for investors include:

- Property: Lot size, age of home, vacancy data, zoning

- Ownership: Absentee owner in the area, out of the county, out of state, ownership type, number of properties owned

- Distressed: Notice of default filing, foreclosure stage

- Demographics: Age of owner, occupancy type, email, and phone available

- Value and Equity: Value range and percentage of estimated equity

- Transfer Data: Date of last transfer, type of transfer, and buyer name

- Liens: Lien type, lien status, lien amount

- Property Taxes: Tax delinquency, years delinquent, and the delinquent amount

While the competition is buying outdated and large generic lists, a savvy professional knows the importance of building hyperlocal and hyper-targeted lists. It saves money because the lists are smaller, but more importantly, messaging can change to target the recipients better, improving response. Take, for instance, the opportunity to explore absentee owners.

Understand: Landlords become motivated sellers for various reasons, but let's explore the same list by only looking at details of absentee owners in Phoenix, AZ that purchased the property before December of 2011.

The list is now more manageable at 8,000 leads, and we can see popular areas for rentals on the map. Creating a list with added insights gives you even more power to see trends in the properties and the people behind them.

First, we'll explore property insights.

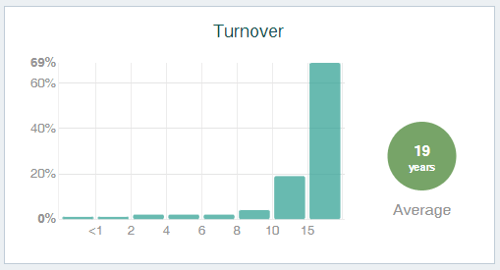

The snapshot of absentee owners shows us that the properties they own are smaller than what flippers target with a slightly lower price point. Value and age are similar to flipper inventory. The average years held is 18 years.

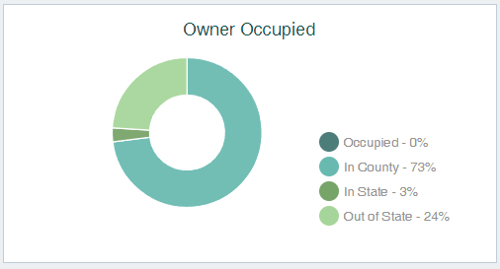

The majority of the owners are local real estate investors that live in Maricopa County. However, almost 25% live out of state, meaning they may not be attached to local trends, property conditions, and how well the property is managed.

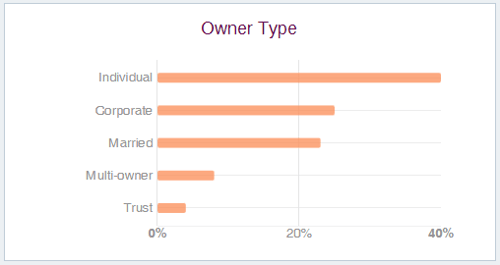

Mom-and-pop landlords make up over 60% of the market (Individual plus married owners). Corporate owners could mean a property is a Wall Street Institutional landlord or an investor that holds properties in an entity. An investor may decide to avoid corporate owners since Wall Street is unlikely to sell.

The list targeted properties between 1,250 and 2,000 square feet. We may decide to look at smaller properties since many appear in the 1,250-1,500 square foot range. Properties over 50 years old tend to be a little smaller which could mean lower renovation costs.

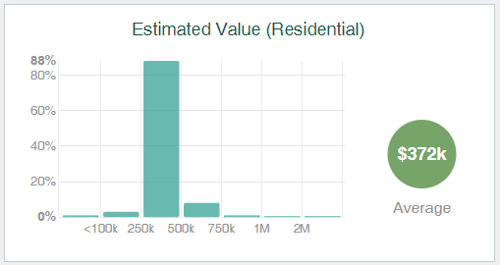

The vast majority of properties on this list are $500,000 or less. Values will change over time, but you can save money by refining the list to target properties in a preferred value range. Why target expensive properties if an area won't get high enough rents to cash flow?

We created this list looking at landlords that have owned for at least ten years. But the data shows that Phoenix landlords are holding for closer to 20 years. We could target newer landlords but it would probably waste time and money. As landlords approach 27.5 years of ownership, the landlord has likely taken all the depreciation benefits. The longer they own, chances are they are also sitting on large capital improvement projects to continue getting top rents.

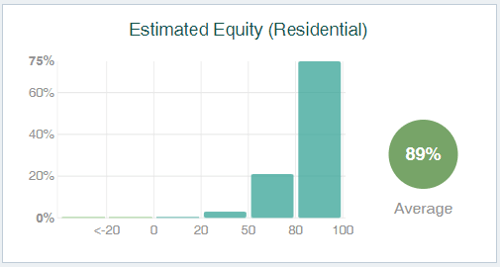

Phoenix landlords on this list are sitting on a ton of equity. 75% of the owners have 80% or more of equity. You can further target the list by focusing only on landlords with 50% equity or more.

An investor can create a refined list better to target their marketing with these seven property insights. The insights help investors explore criteria they may not have even thought about previously. But it doesn't end there. Insights goes beyond property details and allows you to see owner demographic information.

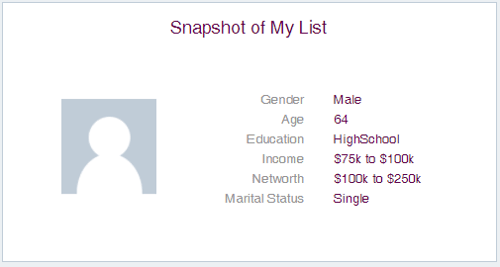

We already know that 60% of our list are mom-and-pop investors that are single or married. The most popular owner is a single male that is approaching retirement.

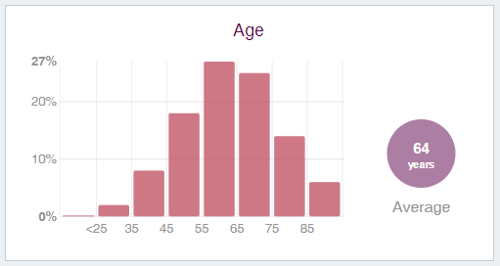

Owner age data show us a large percentage of owners are over 55 and approaching retirement. As we age, we typically become net sellers of real estate. Landlords often sell because they get tired of the three Ts (tenants, toilets, and trash). However, these landlords may need the income. An investor that hones the list targeting landlords based on age and equity position may find owners with more than one rental property.

Seeing the data helps us more easily understand opportunities around niche real estate. Based on the findings, let's refine our list to target owners by adjusting the following:

- Property square footage: 1,000-2,000 (see if we can include smaller properties)

- Property age: 25+ years old (include properties older than 50 years)

- Ownership: Target non-corporate owners

- Ownership: Target owners that have a mailing address outside of the state

- Number of properties owned: 2+ (targeting investors that own at least two properties)

- Equity: At least 50%

- Value: Max $500,000

- Owner: 60+

Our new absentee owner list in Phoenix is now under 1,000 leads. While the competition is spending thousands to communicate with much larger generic lists, this refined list better targets our absentee owners with equity, who own multiple properties, and are nearing or are in retirement. Better yet, we can create a dynamic list that automatically adds new leads to our list when they match this set criteria.

Connecting With Real Estate Investing Leads:

Armed with this well-defined absentee owner list, it's time to decide how to connect with the leads. There is no lack of marketing channels an investor can use to connect with prospects, but having a hyper-targeted list gives us some options not possible when we look at other types of marketing channels.

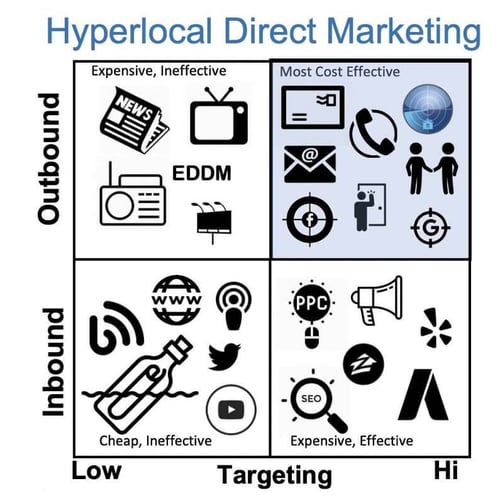

Outbound Low Target Marketing

Newspapers ads, television, radio, billboards, and every door direct mail is costly, untargeted, and largely ineffective. Worse, it's not always easy to track success.

Inbound Low Target Marketing

Podcasts, websites, YouTube, and other social media sites are often touted as low-cost marketing channels and even "free." Your time to participate in these channels is not free. And you're competing with an unending stream of content uploaded every second.

Inbound High Target Marketing

Paid ads, social media ads, and other targeted inbound channels are effective but expensive. There's also a third party sitting between you and your prospect. There's a better way.

Hyperlocal and Hypertarget Outbound Marketing

Enhanced public records that include phone numbers and emails allow you to create hyper-targeted lists similar to the absentee list we created. Door knocking, phone calls, emails, direct mail, text messaging, and targeted social ads are easy. There is no need to waste money on broad campaigns. The marketing channels you select can be specific to the audience and how you best want to communicate with them. When you take this marketing approach, you play smarter than Wall Street and communicate in ways and channels they won't.

Scaling Your Real Estate Investment Business with Automation

We have shown how professional real estate investors create hyperlocal and hyper-target lists that save money and increase marketing return on investment. The real experts take the concept one step further to scale their business by introducing automations to their business.

Automations

Creating dynamic lists means that your list is never stagnant. New prospects that meet set criteria get added automatically. You can turn on email or in-app alerts that tell you when a new prospect meets your list criteria. Instead of downloading a new list, you're connecting with your leads as they come in. Automation gets you in front of them first.

Integrations & Tools

Take automation a step further with services like Zapier, which integrates dynamic lists with over 3,000 marketing and communication tools like CRMs, email, direct mail, texting, and productivity software. There is no need to download and import leads when new prospects that match your targeted criteria appear. They are immediately pushed into your favorite tools you're already using.

Workflows

Workflows are pre-defined activities that are automated. Some tools, like CRMs, have incredible capabilities to launch workflows. The same goes for select marketing houses that can take as little as one lead and launch a preset sequence of activities. Imagine a new lead that meets the absentee landlord criteria. That lead gets pushed to a marketing house that can immediately initiate a well-defined marketing workflow you develop, including:

- Immediate: Direct mail piece with handwritten address, 1st class stamp, and name merge throughout the piece

- Day 7: Text message asking if the prospect received the letter

- Day 14: Follow up postcard

- Day 21: Email notice to you to call the lead by phone and ask for the landlord by name

The activity sequence is entirely up to your imagination, but it's all automated with no action required from you until day 21. By the time you call, they've received two direct mail pieces and a text message. You can even drive by the property and take photos of the current condition to share with the landlord on the call and to also keep in your records.

Building Your Real Estate Investing Team

As a small business grows, owners soon discover they are spending lots of time doing things they don't like or that don't actively contribute to the bottom line. There are three ways to add to your team to help scale.

Referrals: Building relationships with service businesses you use during rehabs like landscaping, roofing, drywall, and window installers can turn your contractors into lead machines. They don't need to go on payroll to send you potential deals on burnouts, insurance claims, or a neighborhood eyesore. When they understand what you are looking for, the mutually profitable relationship motivates them to send you leads as they go about their daily business.

Outsourced: Virtual assistants, interns, or hired specialists are ways investors get the help they need to scale. Virtual assistance can help with marketing assets, research, phone calls, scheduling, and texting. Interns can sometimes get college credit for helping with specific activities aligned with their degree in marketing, bookkeeping, and project management. Other hired specialists can help fill talent gaps that you don't need full-time on your team.

Insourced: Bringing employees on is a big decision. Inhouse employees can keep projects running and crews on target while an owner takes a vacation. They can also focus on filling talent gaps in marketing, accounting, and project management, which frees up time for the owner to find and close more deals, or focus on the activities they do best.

Automations, integrations, and workflows give Main Street investors the speed, savings, and scale to compete with massive corporations. When it is time to hire, employees can be more efficient, processes are more transparent, and success is easily repeatable.