Government Policy Intervention Increasing Neighborhood Blight

A new Federal Reserve Bank of Boston discussion paper by Lauren Lambie-Hanson titled, “When Does Delinquency Result in Neglect”, links the deterioration in certain Boston, Massachusetts properties to various phases of the foreclosure process. Specifically, the study found that borrowers begin neglecting property maintenance when they are 90 days or more delinquent. Property distress (neighborhood blight) becomes more common as the length of the foreclosure process increases and worsens once the property becomes bank-owned (REO).

While this well-researched study correctly links neighborhood blight to the length of the foreclosure process, it offers only a passing mention of what we consider the underlying problem – government policy interventions that have lengthened the time to foreclose.

Since the beginning of the foreclosure crisis, the time to foreclose has skyrocketed. In California, for example, the time to foreclose now takes more than 300 days, up from an average of 140 days in 2008 (PropertyRadar.com). Meanwhile, the time to foreclose in Massachusetts is 440 days and a whopping 820 days in New York (FannieMae).

In our opinion, one of the most obvious solutions to foreclosure-induced neighborhood blight is to reduce government obstacles to the foreclosure process and shorten the foreclosure timeline.

We would love to hear what you think.

Madeline Schnapp

Director of Economic Research

PropertyRadar.com

530-550-8801 x27

Follow Us:

Facebook | Twitter | LinkedIn | Google+ | Pinterest | SlideShare

About Madeline Schnapp:

Madeline Schnapp brings more than 20 years of economic analysis and forecasting experience to PropertyRadar. Prior to joining PropertyRadar, Madeline was Director of MacroEconomic Research for TrimTabs Investment Research, Inc., a leading provider of financial research to the institutional investment community. While at TrimTabs, Ms. Schnapp was responsible for developing several proprietary real-time economic indicators to track employment, job demand, wages and salaries and disposable income well in advance of traditional government indicators. Prior to TrimTabs, Ms. Schnapp was Director of Market Research with O’Reilly Media, and pioneered the use of web spiders to track real-time economic activity in the information technology sector.

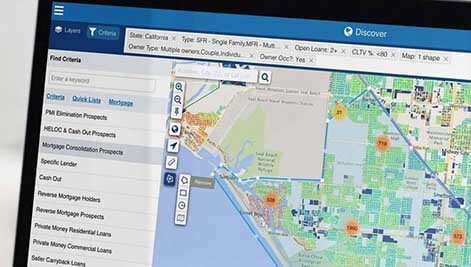

About ForeclosureRadar®:

ForeclosureRadar.com features unprecedented tools to search, manage, track and analyze pre-foreclosure, foreclosure auction, short sale and bank owned real estate. PropertyRadar has been serving its customers for nearly five years and counts several thousand investors, Realtors®, government agencies and other professionals among its subscribers. PropertyRadar has been cited as an authoritative source by Bloomberg, 60 Minutes, Wall Street Journal, Associated Press, and other leading media outlets. The company was launched in May 2007 by Sean O’Toole, who spent 15 years building and launching software companies before entering the foreclosure business in 2002. From 2002 to 2007, Sean O’Toole successfully bought and sold more than 150 foreclosure properties in California. PropertyRadar is privately held and based in the North Lake Tahoe Area.