Auction investors see fewer deals, better margins

Discovery Bay, CA, July 13, 2010 - PropertyRadar (www.propertyradar.com), the only website that tracks every California foreclosure and provides daily auction updates, issued its monthly California Foreclosure Report for June 2010. Foreclosure activity was mixed in June after being down across the board in May. Filing of new foreclosure notices rose, while foreclosure sales dropped. The number of foreclosure sales that were cancelled hit an all-time record in June, but the increase was primarily driven by just one lender JP Morgan Chase, and its acquisitions including Washington Mutual. Although the number of properties purchased by 3rd parties at auction dropped significantly, they purchased nearly the same percentage of the total properties sold, and at a better discount to market value than we've seen in months." Historically it is very unusual to have more Notice of Trustee Sale filings than Notices of Default" says Sean O'Toole, Founder and CEO of ForeclosureRadar.com. "But with skyrocketing cancellations and the possibility of failing loan modifications, this will be increasingly common, as lenders are only required to file a Notice of Trustee Sale to restart the foreclosure process."

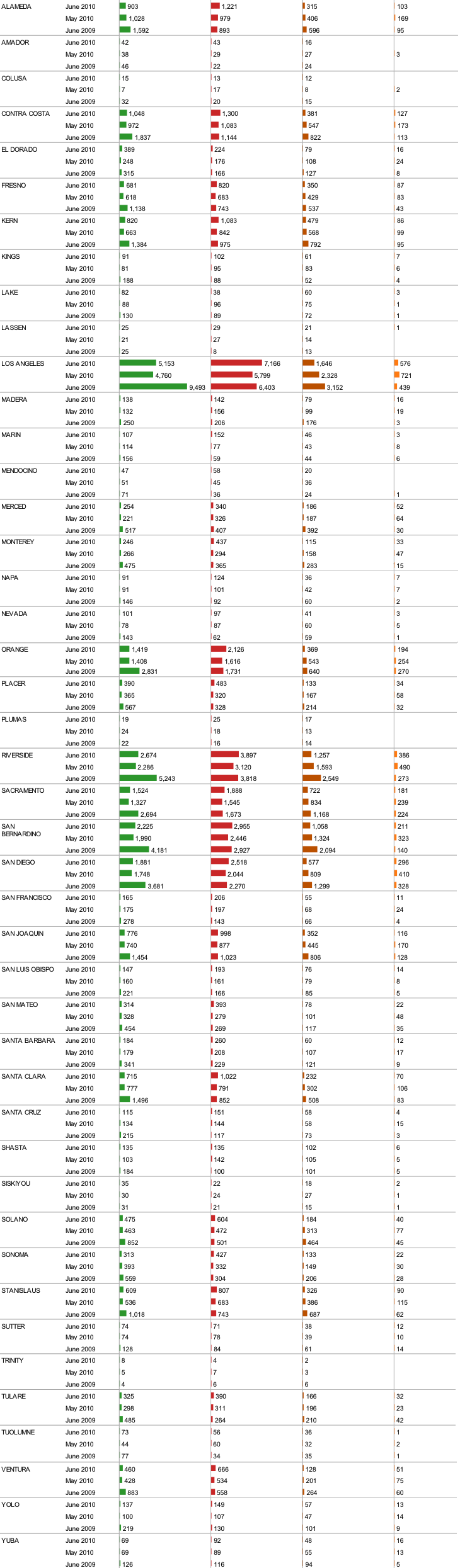

Foreclosure Filings

Notice of Default

| Prior Month | Prior Year |

| 6.74% | -45.24% |

Notice of Trustee Sale

| Prior Month | Prior Year |

| 21.93% | 11.56% |

Notice of Default filings is the first step in the foreclosure process. Notice of Trustee Sale filings set the date and time of auction and serve as the homeowner's final notice before the sale.

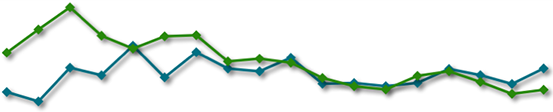

Foreclosure Outcomes

Cancellations

| Prior Month | Prior Year |

| 27.09% | 153.19% |

Back to Bank (REO)

| Prior Month | Prior Year |

| -23.73% | -46.71% |

Sold to 3rd Party

Prior MonthPrior Year-26.24%10.73%

After the filing of a Notice of Trustee Sale, there are only three possible outcomes. First, the sale can be Cancelled for reasons that include a successful loan modification or short sale, a filing error, or a legal requirement to re-file the notice after extended postponements. Alternatively, if the property is taken to sale, the Bank will place the opening bid. If a 3rd party, typically an investor, bids more than the bank's opening bid, the property will be Sold to 3rd Party; if not, it will go Back to Bank and become part of that bank's REO inventory.

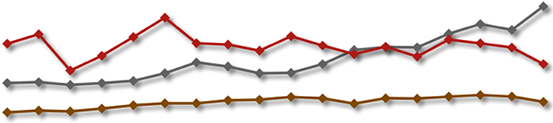

Foreclosure Inventories

Preforeclosure

| Prior Month | Prior Year |

| 8.86% | -15.69% |

Scheduled for Sale

| Prior Month | Prior Year |

| -0.99% | 15.74% |

Bank Owned (REO)

| Prior Month | Prior Year |

| -4.89% | -19.79% |

Preforeclosure inventory is an estimate of the number of properties that have had a Notice of Default filed against the property but have not yet been Scheduled for Sale. The Scheduled for Sale inventory indicates those properties that have had a Notice of Trustee Sale filed, but have not yet been sold or had the sale canceled. The Bank Owned (REO) inventory indicates the number of properties that have been sold Back to Bank at the trustee sale, and which the bank has not yet resold to another party.

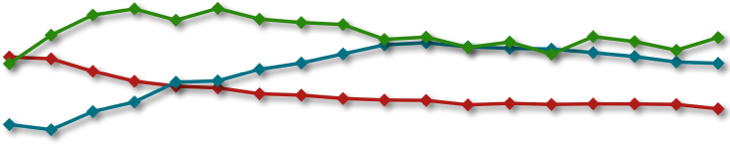

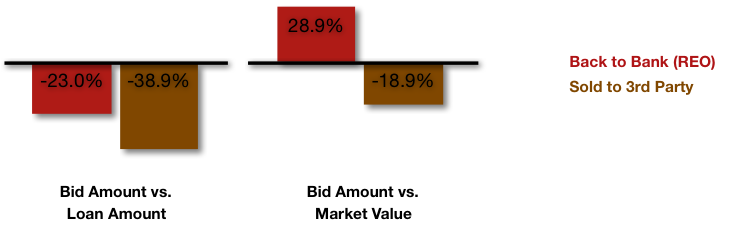

Foreclosure Discounting

Foreclosure discounting compares the winning Bid Amount of properties sold at trustee sale to both the outstanding Loan Amount, and the current Market Value. Banks place an opening bid for each property, and if a 3rd Party does not make a higher bid the property will be sold Back to Bank (REO) for the opening bid amount. While 3rd Party bids are higher than the opening bid, properties Sold to 3rd Parties typically have lower opening bids to start with and therefore deeper discounts to both Loan Amount and Market Value.

Foreclosure Timeframes

Time to Foreclosure

| Prior Month | Prior Year |

| -0.43% | 34.93% |

Time to Resell - Bank

| Prior Month | Prior Year |

| 5.95% | 9.43% |

Time to Resell - 3rd

Prior MonthPrior Year4.29%1.19%Time to Foreclose is the total time from the filing of the Notice of Default to the sale of the property at trustee sale, and reflects those properties sold in the month indicated. Time to Resell reflects how long it takes banks and 3rd parties to resell the properties they take back or purchase at trustee sale.

Foreclosure Activity By County

Notice of DefaultNotice of Trustee SaleBack to Bank (REO)Sold to 3rd Party