Dramatic Declines in Foreclosure Activity

Banks cancel more foreclosures than they sell for the first time

Discovery Bay, CA, January 12, 2010 - PropertyRadar (www.foreclosureradar.com), the only website that tracks every California foreclosure and provides daily auction updates, issued its monthly California Foreclosure Report for December 2009. Foreclosure activity dropped dramatically in December, especially when looked at on a daily average basis. For example, while Notices of Default dropped 17.5 percent in aggregate, they actually dropped 32.5 percent on a daily average basis due to the fact that December had 22 days on which documents were recorded, versus 18 in November." The dramatic drop in foreclosure activity may have been a Christmas gift to homeowners," says Sean O'Toole, Founder, and CEO of ForeclosureRadar.com, "however, given rising mortgage delinquencies it is becoming increasingly clear that foreclosure activity no longer fully represents market realities".

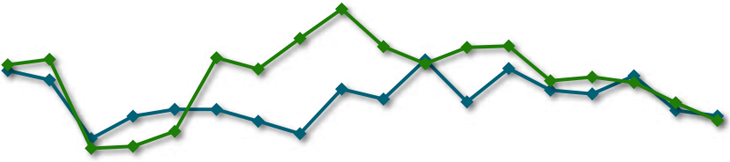

Foreclosure Filings

Prior MonthPrior Year-17.50%42.85%

Notice of Trustee Sale

Prior MonthPrior Year5.98%-6.92%

Unlike November where we saw nearly flat foreclosure filings on a daily average basis, with declines being due to the holiday-shortened month, the decline in December foreclosure filings is actually understated due to the increased number of recording days. On a daily average basis, Notice of Default filings dropped a dramatic 32.5 percent from November, and Notice of Trustee Sale filings dropped 23.0 percent. We have not seen a similar December drop in recent years, so this is not simply a regular seasonal decline.

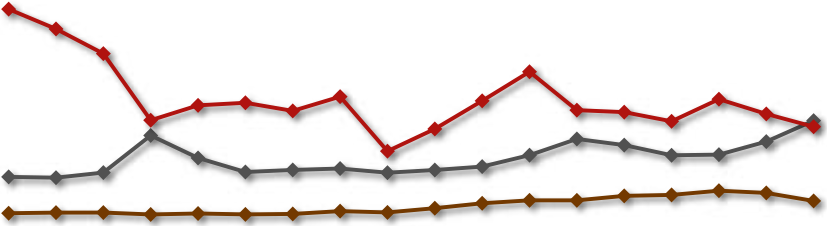

Foreclosure Outcomes

Back to Bank (REO)

Prior Month Prior Year

11.99%-20.32%

Cancellations

Prior Month. Prior Year

26.50%105.48%

Sold to 3rd Party

Prior MonthPrior Year

-28.89%213.81%

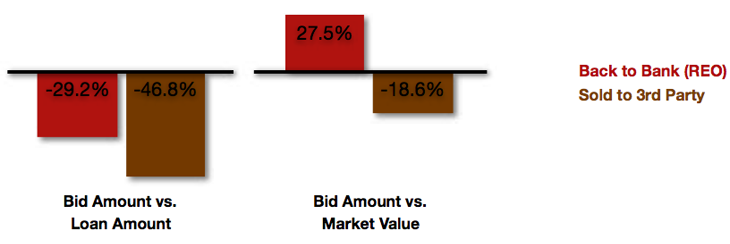

When taking into account the difference in sale days from November to December, the percentage declines are far more dramatic than they first appear with foreclosure that went Back to Bank and Sold to 3rd Party declining 28.0 percent and 41.8 percent respectively. The reason for the dramatic drop in Sales to 3rd Parties appears to be a significant decline in foreclosure discounting by lenders, rather than investors taking time off to celebrate a very profitable year at the auctions.

On an average daily basis, Cancellations only increased 3.5 percent - a smaller increase than we expected given the Obama administration's drive to make trial loan modifications under their Home Affordable Modification Program permanent. Based on the timing of these Cancellations, we believe 21 percent were canceled due to the statutory requirement that a foreclosure sale is held within one year, thus forcing cancellation; 61.9 percent were likely due to some form of loan workout, whether it be through a HAMP modification, short sale or refinance; and 17.1 percent most likely due to a filing error.

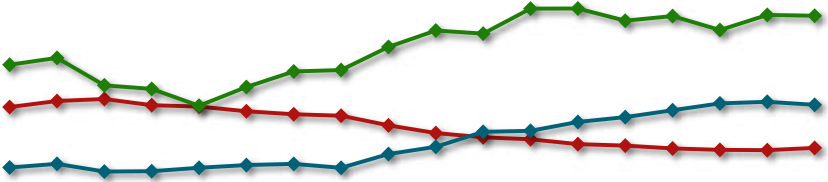

Foreclosure Inventories

Preforeclosure

Prior Month. Prior Year

-0.40%. 55.12%

Scheduled for Sale

Prior Month. Prior Year

-2.64%. 117.52%

Bank Owned (REO)

Prior Month. Prior Year

3.41%. -34.89%

We are excited to add an estimate of the current inventory of properties in the Notice of Default, or "Preforeclosure" stage of foreclosure. This estimate takes into account the number of new Notice of Default filings each month, and the average time it takes before moving to the next stage with the filing of a Notice of Trustee Sale. Despite the downward trend in Notice of Default Filings since March 2009, Preforeclosure inventories have been rising as banks are taking longer to file Notices of Trustee Sale.

Foreclosure Discounting

The discounts received by 3rd party investors at the courthouse steps dropped dramatically in December, likely explaining the steep drop in the number of foreclosures sold to 3rd parties. For most of the last year, lenders discounted the opening bid from the amount they were owed by nearly 40 percent, last month that dropped to 33.7 percent. The percentage of sales that were discounted also declined, from nearly 90 percent one year ago, to just 75 percent in December.

Foreclosure Sales by Loan Origination Date

Despite prices now well below 2004 levels in many areas, loans made in 2004 and earlier remain a very small percentage of foreclosures.

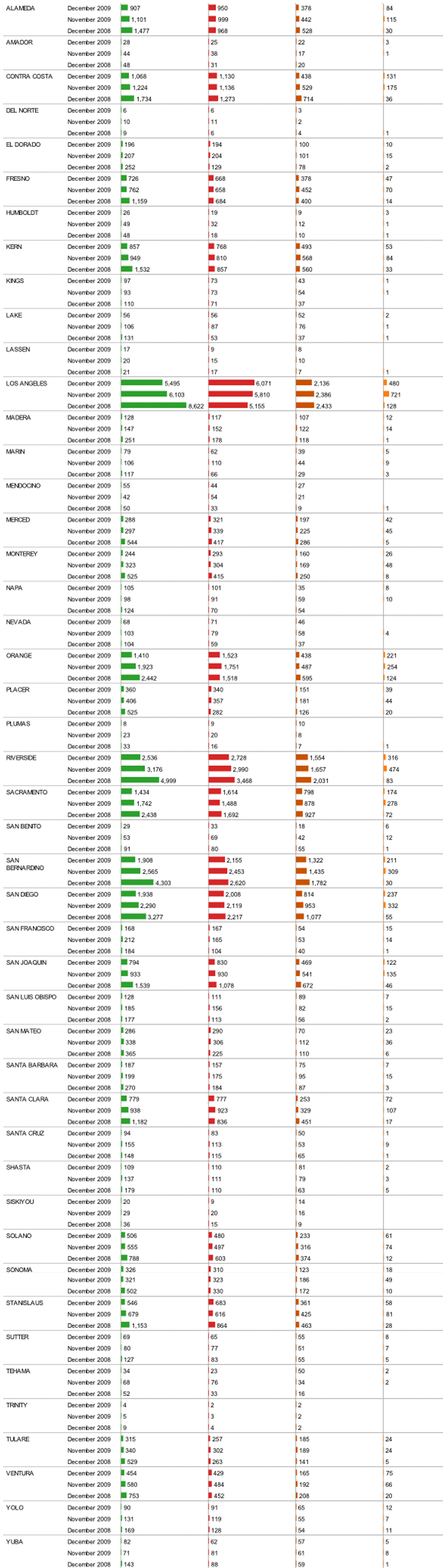

Foreclosure Activity By County